You Can Still Get Rich and Make Money In a Terrible Economy with a Miserable Stock Market

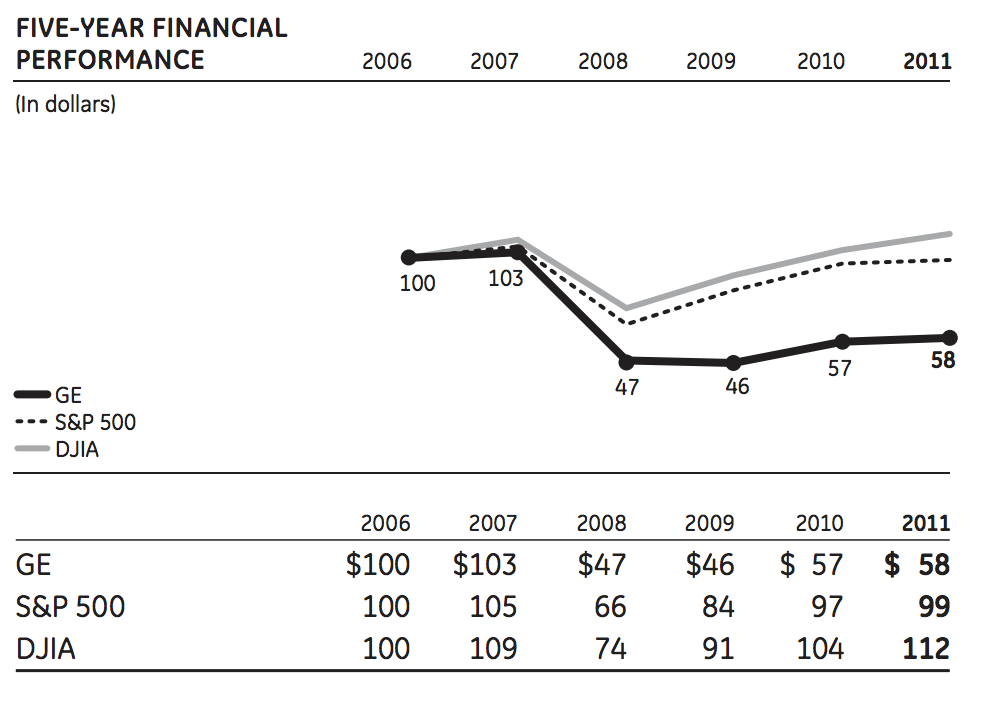

Towards the back of the most recent General Electric annual report is an interesting graph. It shows what an investor would have experienced by putting $100 into three different investments: GE shares, the S&P 500, and the Dow Jones Industrial Average. It assumes that dividends were reinvested in each respective investment when they were distributed. How were you rewarded for six years of patient investing, assuming you added no fresh cash outside of the dividend reinvestment? Take a look.

The chart assumes that dividends were reinvested when paid.

The performance is even worse than it appears because it doesn’t factor the inflation rate into the end results. You began with $100 in 2006. Even if the various investments had been at $100 six years later, you would have lost money because you lost purchasing power. It doesn’t matter that you hold the same amount of dollars. You can buy less; give less away.

Yet, here is the interesting thing. That chart encapsulates my entire post college career. I graduated from high school at the end of 2000 / beginning of 2001. I moved away from the Midwest, earned my undergraduate degree, and then returned at the end of 2005 to setup my businesses, some of which began in the dorm room and apartments. Those six years were the time period during which I had no other focus except establishing my life. Those six, terrible years, which saw the worst recession since the Great Depression, a collapse of the residential real estate market, bankruptcies of the oldest and biggest firms on Wall Street, and out of control government spending, are the same ones when my net worth and income kept climbing higher.

You are not hostage to a bad economy. If you can find intelligent things to do, you can find a way to make a profit doing it (which simply means spending less than you bring in to produce the goods or services you sell), and you avoid stupid mistakes, you can get there in the end. Recessions, even depressions, are a normal part of the economic cycle. Inflation is a foe that needs to be battled. Get used to it. If you think you need smooth waters to sail to your destination, you are going to be disappointed. It won’t happen. It’s just an excuse. Your job, as captain, is to make sure the ship doesn’t sink.

The richest man in the world at this moment made his fortune in Mexico during decades when the country devalued the peso and saw crippling poverty. If you want to be rich, get rich. Stop blaming the economy. Adjust to it.

Footnote: An interesting aside is that charts like this ignore how real men and women invest their money in the actual world. Most intelligent people engage in some form of dollar cost averaging. They would have been regularly contributing to their investment accounts as the stock prices declined, allowing their dollars to buy a higher ownership stake in the business(es). As the levels recovered back to baseline, they would have actually made money.