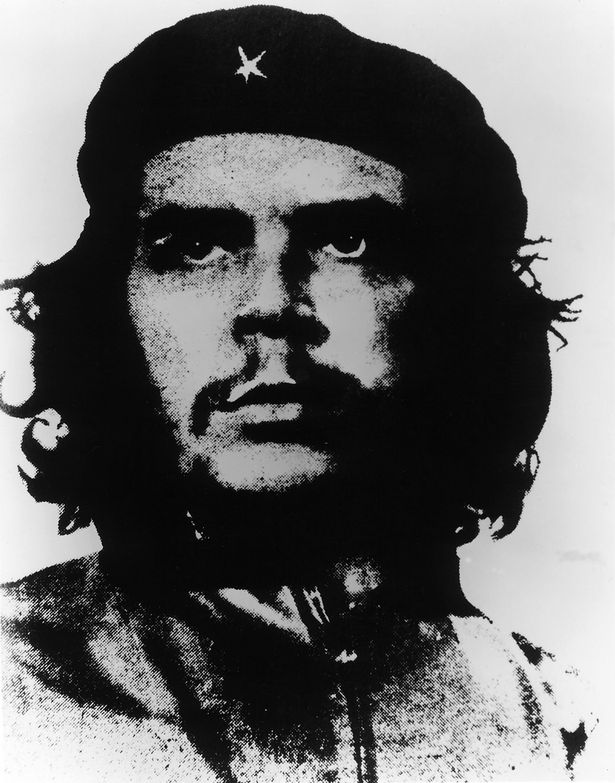

Unless You Are a Proud Bigot and Anti-Intellectualist, You Probably Shouldn’t Be Walking Around with Che Guevara On Your T-Shirt

I believe in wild, autonomous levels of individual freedom. Provided you aren’t harming anyone, neither your neighbors nor the government have the moral authority to prevent you from seeking your own happiness. It is immoral for parents to force their children into marriages, as still goes on in parts of the world. It is immoral…