More than 200 years of research shows that owning stocks, which represent an ownership stake in a business, is the best way to generate long-term wealth. Our stock investing guides will explain how common stocks work, what preferred stocks are, how to understand dividends, stock basics for new investors, and advanced stock trading techniques for those who are ready to learn the deep knowledge of finance.

[vc_row][vc_column][vc_column_text css_animation=”none”] [/vc_column_text]

[/vc_column_text]

I’ve received a significant number of requests over the past few months asking that I discuss what is happening with oil, natural gas, pipeline, and refining companies; to explain how I look at the situation and the sorts of things Aaron and I discuss when we’re allocating our own capital or the capital of those who have entrusted their assets to us. It’s a big topic with a lot of niche considerations but I want to take some time today to address the oil majors; the handful of mega-capitalization behemoths such as ExxonMobil, Chevron, Royal Dutch Shell, Total, ConocoPhillips / Phillips 66, and BP.

After so many years of investing, interacting with people, and writing about stocks, mutual funds, index funds, and portfolio management, I have five theories that help explain investor behavior.

Back in 2011, I did a 20-year case study of Colgate-Palmolive. Global events have conspired in such a way that it can now serve as a perfect illustration of a valuation conundrum: While not cheap, Colgate-Palmolive is significantly cheaper for a long-term owner than the price-to-earnings ratio alone would have you believe. In fact, despite having what appears to be a 26.54 p/e ratio, it’s slightly undervalued to its private market value could you get your hands on the entire empire. It’s a rare thing to be able to talk about a gem like this under conditions such as these so I’m not going to let the opportunity pass. Dust off your powdered wigs, take out your walking cane, and travel back with me to post-Revolutionary America.

On August 9th, 1995, the company behind Internet browser Netscape went public, skyrocketing as people fought to get a piece of the so-called “new economy”. It set off a buying panic among the public that lasted five years; otherwise rational men and women convinced that this time really was different, the mania feeding on itself. Anything and…

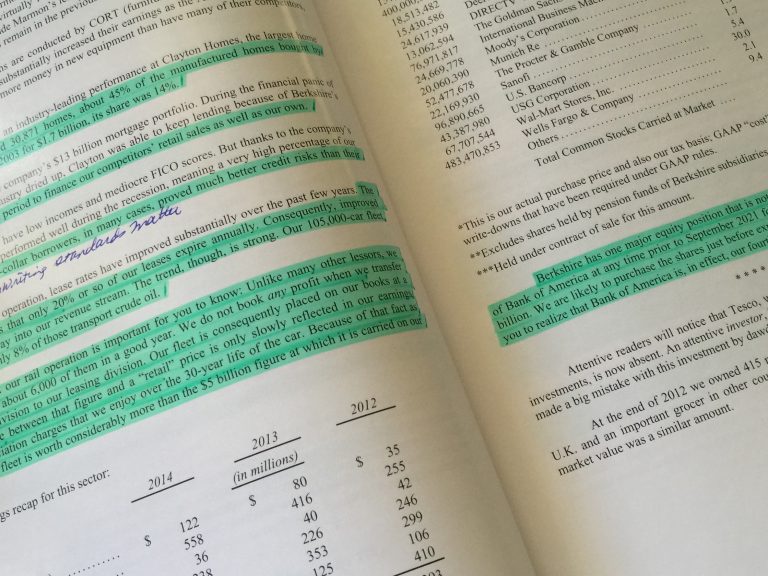

Surveying the most recent ten year period, the increase in Berkshire Hathaway’s economic engine has been breathtaking. The Great Recession of 2008-2009 gave it the opportunity to lay out billions upon billions of dollars in cash it had been storing for years prior at terms that were unlike any deals we’ve seen in decades. Convertible preferred stocks, warrants, private buyouts … the firm got its on hands highly lucrative securities, many of which were privately negotiated and offered return enhancers not available to average investors …

Now that the dividend has been paid on the Swiss shares (April 22nd), the stockholder meeting concluded (April 16th), and Citibank is working with the Swiss Tax Authorities to distribute all of those beautiful Swiss Francs shipped over from Vevey to the United States for holders of the ADR to receive their U.S. dollar equivalent payouts later this month on May 29th when the process has completed (can you believe it’s already been a year since the last time we had this conversation?), I wanted to write about Nestlé.

March 3rd, 2015, is the 10th anniversary of National Pancake Day. If you head to an IHOP, you can get free pancakes. They ask, but you are not required, to make a donation to charity in lieu of paying for your meal, with the goal being to raise $3,500,000 this year for Children’s Miracle Network Hospitals.

You might want to consider bringing your own maple syrup, though. As you know, one of the few things in life that irritates me to no end is the (what I consider) stupidity of the pancake industry, which has now, in 2015, nearly completely replaced every single store brand maple syrup with “pancake” syrup instead, which is really dyed corn syrup.

As we approach the end of 2014, I’m looking back on the year. One of the major changes from an investing perspective what a modification Aaron and I made in the investment policy manual. That doesn’t happen often. We added a handful of companies to the list of permanent business; those companies we consider so…

It’s been a long time since I’ve talked really about Nestlé SA other than mentioning it in passing last week. It was on my mind this morning, so I wanted to revisit it and talk about the business.

Long story short, I’ve been looking into Taipei for various reasons and, in the process, discovered that McDonald’s serves limited edition White and Black burgers there. Besides the fact it warms this American’s heart to know that I’m collecting New Taipei dollars (McDonald’s dividend day was last week and, with the exception of my two sisters, I have practically every member of my family holding shares somewhere, so the deposit is fresh on my mind as I saw it come in across the accounts), I would very much like to try these out of sheer curiosity.

[vc_empty_space][vc_column_text css_animation=”none”]

[/vc_column_text][/vc_column][/vc_row]