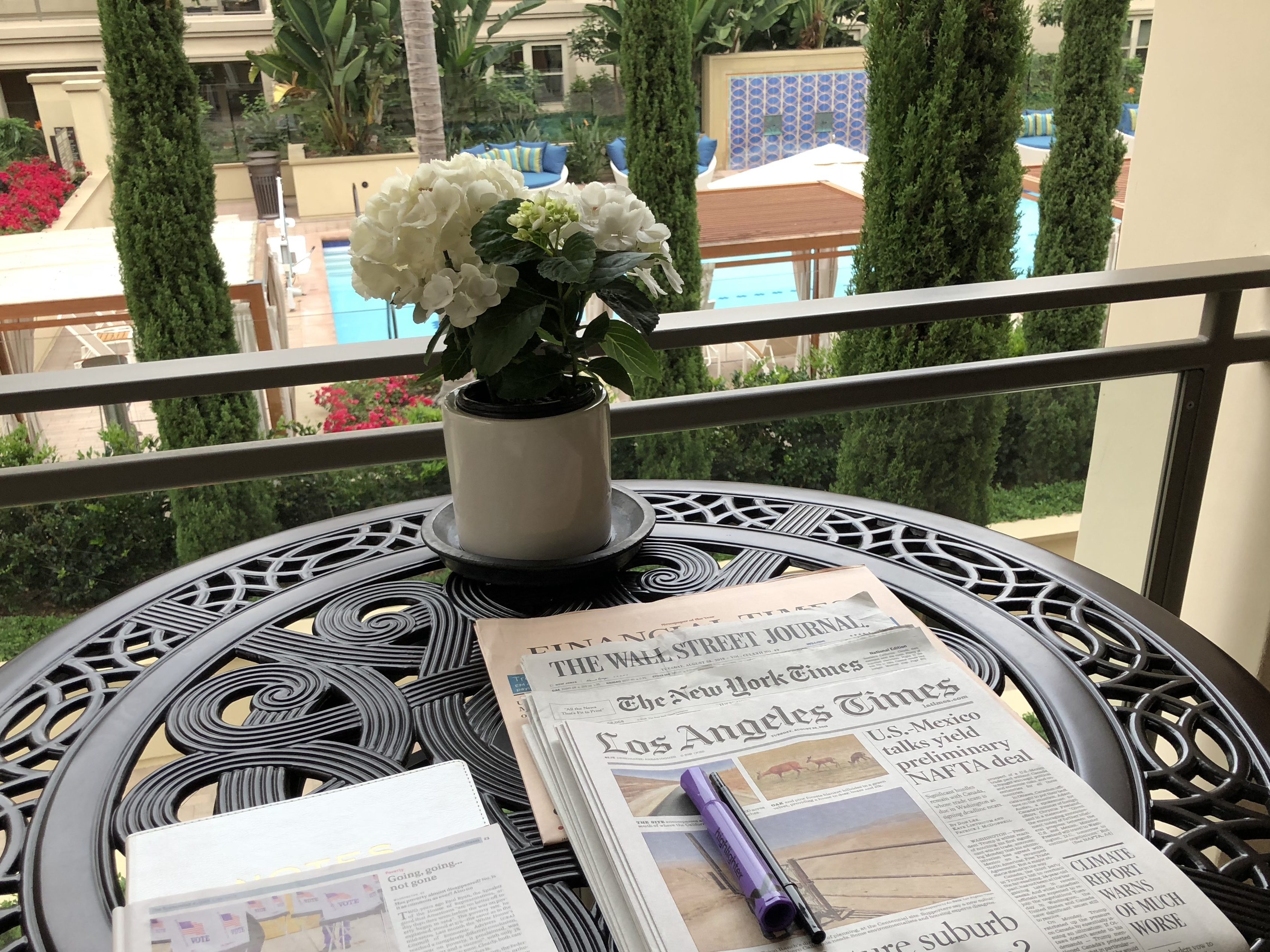

It is not an exaggeration to say that most of my life and career has been spent reading, writing, and thinking. In many cases, I turned around and taught others a synthesized version of what I absorbed, putting my own spin on it. My favorite place in the world during childhood was the public library and even now, I am typing this post surrounded by enormous bookcases overflowing with volumes on everything from trust fund structures to biographies of oil and banking titans. Reading allows me to satisfy a nearly insatiable curiosity about the world. More than any other behavior, it has been responsible for my success.

Details