The Socialists Have Taken France

I’ve been watching the French election. Hollande won. He has promised a 75% income tax on the rich and vows to, “re-negotiate a European treaty on trimming budgets to avoid more debt crises of the kind facing Greece.” Looks like we’re selling the French stocks in the retirement funds. I’m not dealing with this s**t. Forgive me the language. Life is too precious, and too hard, to deal with thugs who don’t understand human nature and the velocity of money. A fundamental rule of humanity is that people go where they feel secure and appreciated. I love the United States. If the United States took $75 out of every $100 I earned, do you think I would stay here? If I did, do you think I’d work anymore?

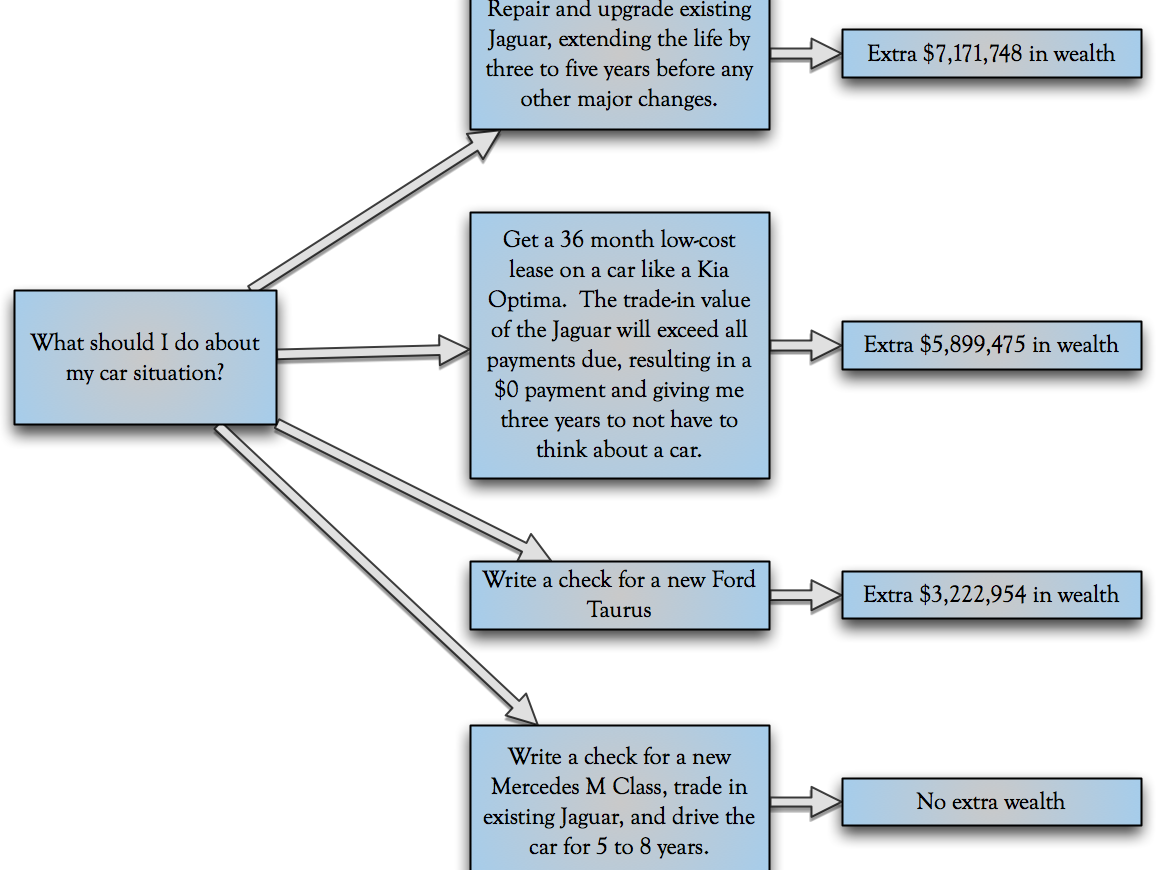

Details