Atlas Shrugged by Ayn Rand Sort of Took Over My Life Today …

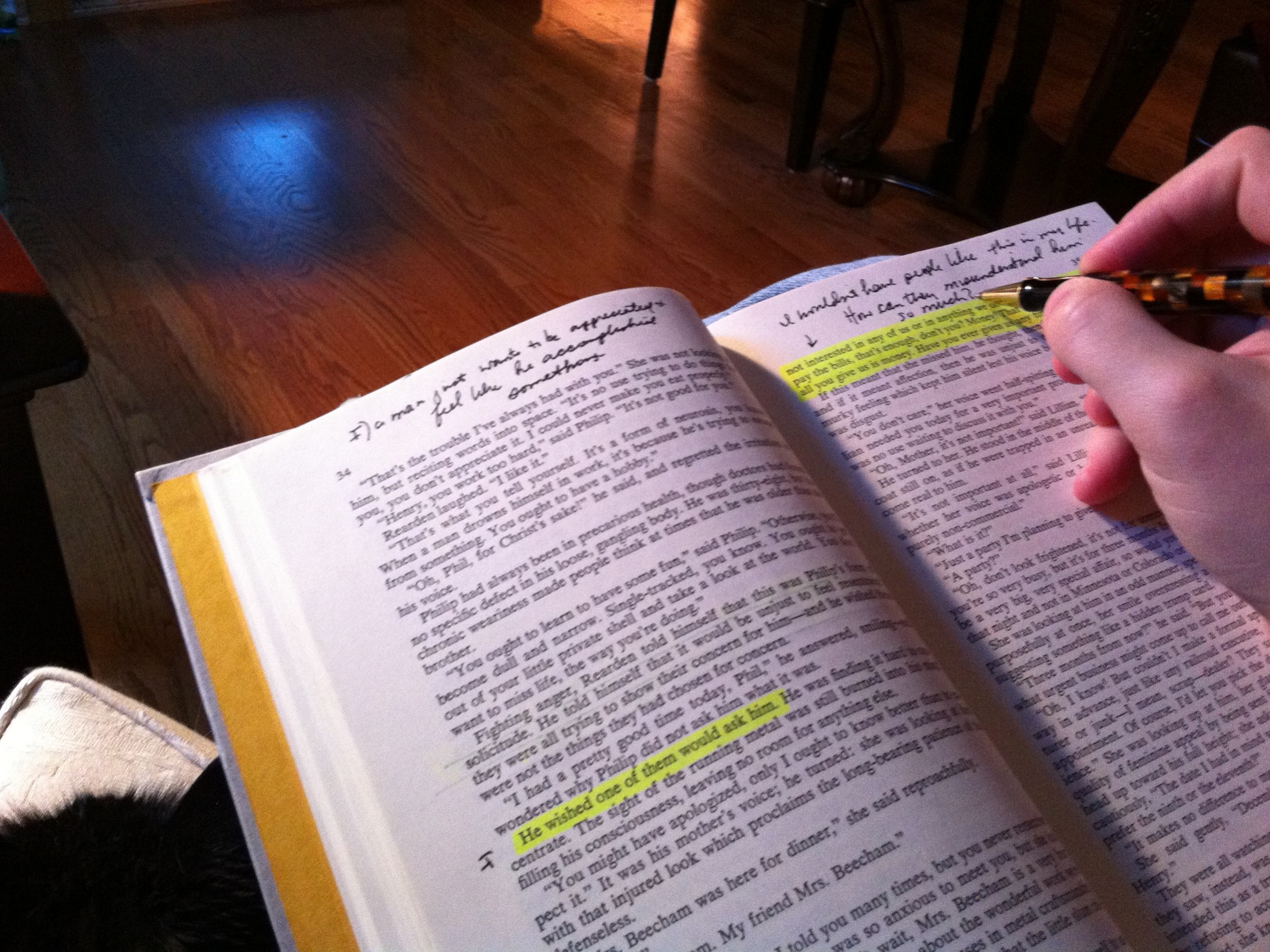

Given the historical importance of the book, and my decision to finally read it, my brief introduction to a few pages of Atlas Shrugged by Ayn Rand turned into an all day affair. I have some very significant reservations about the author’s stated philosophical belief system, Objectivism, but that deserves its own future essay. Suffice it to say, though she gets 70% of the equation correct by supporting free market decision making and individual liberty, I think her model of human behavior is incomplete and therefore not entirely rational and realistic when carried to its logical extreme.

Details