Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

McDonald’s is one of those businesses that I love. The last time we talked about it was when I wrote the 25 Year Investment Case Study of McDonald’s, and showed how you could have turned $100,000 into anywhere between $1,839,033 and $5,547,089 depending on how you handled dividend reinvestment and the Chipotle split-off back in 2006, and the sorely lacking media coverage of McDonald’s results in February. No matter which way you look at it, despite periods of overvaluation and undervaluation, alternating with the underlying performance and the emotional moods of shareholders, McDonald’s has been a fantastic company. It makes its employees and shareholders a lot of money. It gives society something it wants, whether that be a plain salad with side of fresh fruit and a non-sweetened iced tea or a double cheeseburger with french fries and a Coca-Cola.

One of the most important lessons I learned very early in life came from a series of psychology studies that I read for entertainment. It talked about how the big troubles we face – the death of a loved one, the loss of a job, the foreclosure of a home – are often overcome because our natural defense systems activate, causing our behavior to moderate with time so that we accept what has happened, rebuild, and put it behind us. The things that cause unhappiness that is both severe and chronic are not these major shocks; they are the small irritations that build up and wear away at you like Chinese water torture.

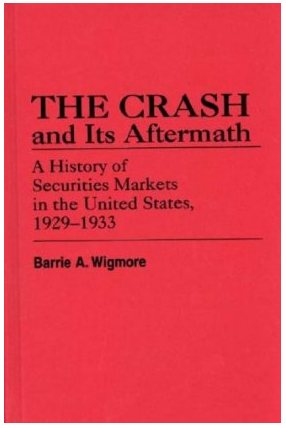

We’ve talked about the 1929 period a lot lately, but what you need to remember is that it was a walk in the park compared to 1933. It wasn’t until then that everyone had gone broke, given up hope, and sworn off stocks for life, leaving great businesses trading at double-digit dividend yields and a…

For the serious investors among you, I recommended a book about the 1929-1933 crash that is the single best statistical resource on the subject I have ever encountered. After talking about it on the site, I’m going back through the 700+ pages and I really can’t emphasize enough how seeing the effects of the worst…

A week ago, I recommended a now-out of print book from 30 years ago that was an academic study of the Great Depression called The Crash and Its Aftermath. It is, hands down, the most useful statistical survey of the Great Depression and the 1929-1933 period I have ever read. It instantly ranks up there…

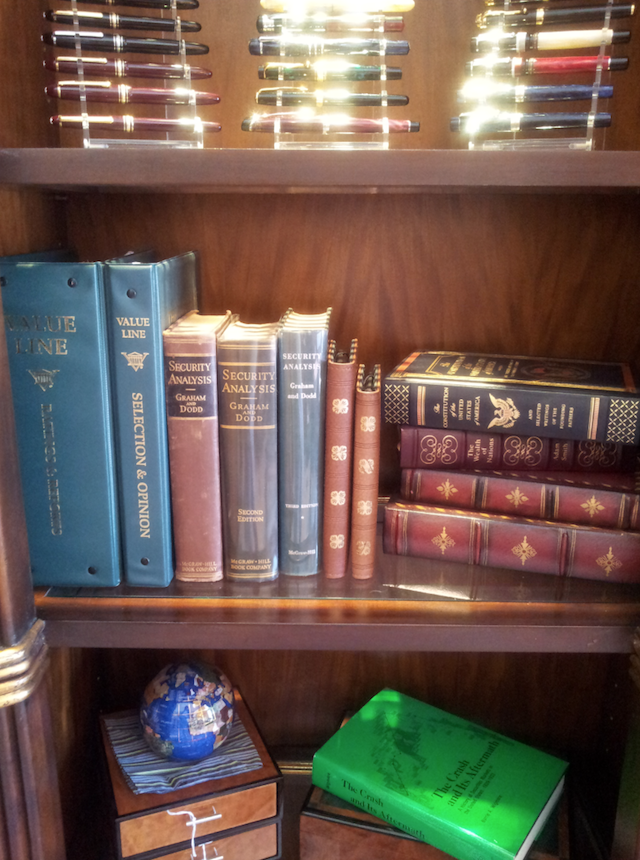

I am committed to this minimalism and de-cluttering project. Since beginning this change, it has been wonderfully freeing. If something hasn’t been used in the past twelve months, it is donated or discarded. Everything has a place and the systems at home were changed so that the basic act of living, going through the day, takes care of keeping everything maintained without any extra work. Now that this phase of the pantry is done, I am turning my attention to the library.

C. Everett Koop, former Surgeon General of the United States, has passed away. He was 96 years old. The devout, conservative, evangelical Christian born the grandchild of German immigrants was one of the great pragmatist of the past few generations, proving that a fact-based, rational approach to life can improve standard of living, reduce disease,…

In 1985, one of the greatest scholarly works ever penned on the Great Depression was published by Barrie A. Wigmore under the title The Crash and Its Aftermath: A History of Securities Markets in the United States, 1929-1933. Using actual data from the period that took years to acquire, analyze, and interpret, Wigmore takes 751 pages…

The developments on the income statement and balance sheet of Union Pacific between 2005 and 2013 are an excellent example of why it is important for you to analyze data yourself, and come to conclusions based on reasonable, rational, intelligently organized facts. The willingness to take action when others do not agree with you, and to have your action backed up by solid evidence, can make the difference between being comfortable and ending up rich. Two of the world’s wealthiest titans demonstrated this truth, not only when buying shares of Union Pacific, but other railroads, as well.

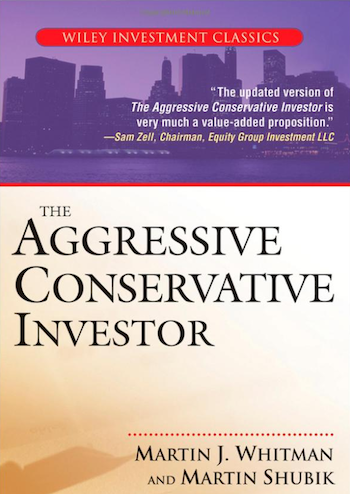

Legendary distressed debt investor, and equity mutual fund manager, Martin J. Whitman has been called “the vulture of Wall Street” for his knack at finding amazing opportunities in beat down securities. When the rest of the world is falling apart, he can often be found, cash in hand, buying up things that will be worth…