Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

I am working on my What is a mutual fund? category at About.com and a thought struck me. I wanted to go back and look at the most recent investing lifetime (the 50 year period between 1960 and 2010). I imagined that an investor could have bought the S&P 500 stock market index (obviously you can’t…

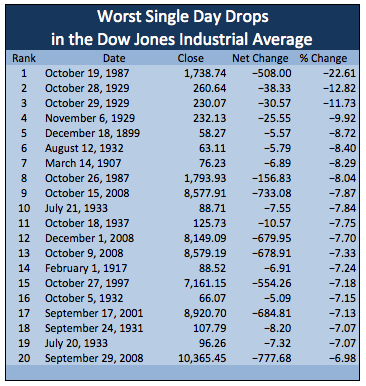

The media is making a big deal out of the recent stock market drops, acting as if we were living through some sort of new paradigm where stock collapses are unheard of and Wall Street rips off small investors. The past 200 years have been a fantastic time to be a long-term value investor despite some…

There is an old Rolex ad featuring the explorer Sir Edmund Hillary. The tagline was powerful. “People do not decide to become extraordinary. They decide to accomplish extraordinary things.” You are nothing more, and nothing less, than the choices you’ve made in your life. Warren Buffett is Warren Buffett because he chose to start a business…

I write a lot about investing in stock and investing in bonds over at Investing for Beginners at About.com, a division of The New York Times. There is a reason I tend to be far more favorable to equity investments (stocks) than fixed income investments (bonds) when it comes to long-term investing and why much…

My lunch with friends yesterday turned into a 3 to 4 hour event as we hung out at a local independent pizza parlor and discussed kids, love, True Blood, taxes, and a host of other things. The topic of poverty came up (as is inevitably bound to happen when the group includes a social worker,…

For the past few years, I’ve kept a file on extended adolescence because it is one of the most common symptoms I see among the thousands of messages I receive each year from readers asking for advice. Often, they are dissatisfied with the way their life is going, yet they almost inevitably suffer from extended…

If I were thinking about starting a small business from nothing or I were actively operating a small family company, there are eight questions that I would immediately ask myself about any entrepreneurial idea I had. These eight questions are: How do we make money? (What product or service do we provide at a profit? What…

Mental Model: Information Asymmetry For the past month or two, there has been a running joke at the office that I’ve been giving Aaron a hard time about, providing me countless hours of entertainment. It is a good illustration of a mental model from economics called information asymmetry and I thought I’d take five minutes…

After writing about the 20 year performance of Colgate-Palmolive stock, my Aunt Donna asked me about Dawn dish soap, which is owned by Procter & Gamble. I broke out the historical dividend charts and went to work to create a comparison of how an investor would have fared had they parked money in P&G twenty…

I’m still running several weeks behind but one of the things I’ve been working on is a response to a few of the questions submitted by FratMan, whom you’ve seen in some of the mail bag sections I believe. He’s mentioned a few times, such as in the comments sections here and here, that he likes…