Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

The New York Stock Exchange is set to reopen today after having been closed for two consecutive trading days as Hurricane Sandy made landfall on the Eastern seaboard. The last time this happened due to weather was in 1888, when a blizzard shut down the city. It could have been much worse. The lesson: You…

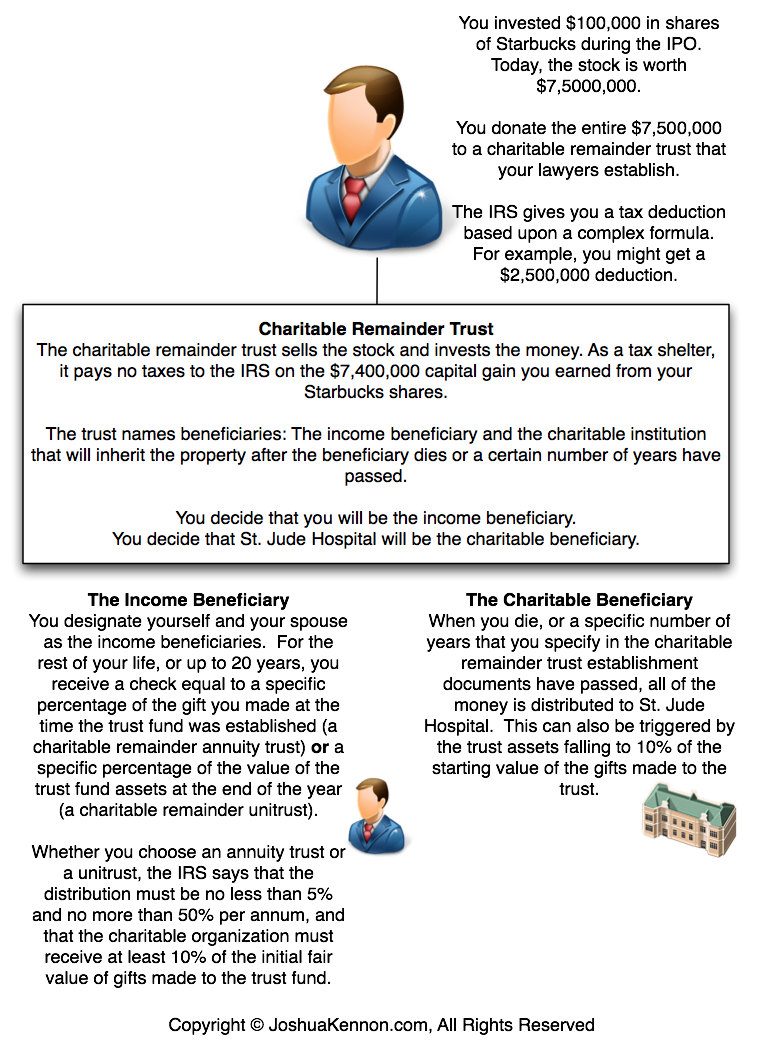

The past day or so, some prominent bloggers have been attacking Mitt Romney for using something known as a charitable remainder trust as a way to lower his tax bill. As someone who is voting for President Obama, let me tell you flatly: This is nonsense. The people demonizing Mitt Romney for his use of…

In Switzerland, there is a 207 year old private bank called Pictet & Cie that caters to the the richest of the rich. It has total assets under management of of 373 billion Swiss francs, or just shy of $400 billion in United States terms.

I often get messages from some of you expressing a desire to invest but not wanting to sign up for a life buried in balance sheets or income statements. The good news: In investing, you can do extremely well if you have a few good, big ideas in your lifetime. You don’t have to become a master of everything. You just need to understand what you are doing, focus on it with the persistence of a pit bull, and be patient during the periods when there is nothing attractive to do, content to sit on cash. There is no need to master every industry, or spend your evenings pouring over the disclosure documents of a pharmaceutical giant to make money. It isn’t necessary.

How to Remain Detached from the Stock Market and Treat Your Investments Like Private Businesses When I was much younger, I kept seeing Benjamin Graham’s famous allegory called Mr. Market mentioned by great economists, investors, and financial historians. I bought a copy of The Intelligent Investor to figure out why everyone was so enthralled with a book…

Whether or not a person is capable of waiting for rewards, and thus succeeding in things that require long-term planning such as investing, money management, completing higher education, and sticking with difficult projects for the promise of richer payouts, may not be due to willpower alone. In a new study, researchers Celeste Kidd, Holly Palmeri,…

Early morning, a giant package arrived from FedEx containing the historical annual reports of a company I’ve been studying for the past couple of weeks. I’ve built positions in most of the accounts under my purview, including my household portfolios. Even though I have read the financials in PDF format, I want to go back through the hardcopy, line-by-line, and make sure there is nothing I am missing.

Mental Model: The Shoichi Yokoi Fallacy Shoichi Yokoi was a Japanese tailor born in 1915. When he was 25 years old, his country sent him to war with the idea that he and his fellow soldiers were to fight to the death and avoid the shame of surrender. In 1944, the United States military seized…

The October panini study continues and I hit upon a huge winner today! It is like autumn distilled into a sandwich. It involves the same eight wheat bread I used yesterday in the blue cheese and plain turkey version, only the meat is a black pepper-edged smoked turkey, with slices of apple-smoked gouda cheese, mayonaise, cranberry chutney, arugula, and a drizzle of olive oil. It would be perfect if you have a cup of spiced cider or apple slices on the side.

Today was one of the most enjoyable days I’ve ever had. Sometimes, it is the really simple things in life that give it meaning. Everything else is a distraction. I’ll probably spend my evening reading.