Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

Many famous portfolio managers that practice a value investing strategy have said they think of stocks as “equity bonds”. Instead of receiving a fixed rate of return, like you would when you buy a traditional bond, you receive a variable return based on the company’s underlying profit. This approach makes it easier to value a business. The most common starting point for the valuation process is calculating a financial ratio known as earnings yield. In this article, you will learn what the earnings yield ratio is, how to calculate it, and why it is important to so many value investors.

In his classic treatise, The Intelligent Investor, Benjamin Graham, the father of value investing, created an allegory to help new investors understand how to think about stock prices and value investing in general. By using it, you can help protect yourself from overpaying for a stock, panicking when the market crashes, or doing foolish things resulting from emotional reactions to the nightly news. Along with the margin of safety concept, Mr. Market is a cornerstone of the value investing strategy.

The single most important concept in all of investing, according to Benjamin Graham and later confirmed by his star student, Warren Buffett, comes down to three simple words: Margin of Safety. What is the margin of safety? How do you calculate it? How important is it to developing a successful value investing strategy? As you’ll see in a moment, the theory behind value investing is that the ultimate return you earn on your investments will be closely related to the size and quality of the margin of safety you build in to your purchasing decisions, whether you are buying shares of Coca-Cola or building a hotel.

Originally serving as stock broker to the father of value investing, Benjamin Graham, Tweedy, Browne & Company converted to a money management company and eventually launched several highly successful mutual funds that operated with the same value investing style for which they had become renowned. After beating the market by several percentage points for nearly forty years, the firm’s place in the halls of investing greats has been securely established.

There are several common characteristics that often present themselves in stocks that are thought to be attractive to those who follow a value investing strategy. From high dividend yields to low price-to-book values, here’s a list if you are new to the concept of value investing.

Charlie Munger, the Vice Chairman of Berkshire Hathaway, former hedge fund manager, and billionaire value investor, was instrumental in changing Warren Buffett’s way of thinking about value investing. Charlie insisted that the investor would be better served by focusing on better quality businesses, even if the price were higher, because those businesses could be held for decades, continually churning out cash and profits for the owners. In fact, it was this influence that resulted in Berkshire Hathaway shifting from acquiring undervalued “cigar butt” companies such the textile mills for which the firm was named to high-quality companies such as Coca-Cola.

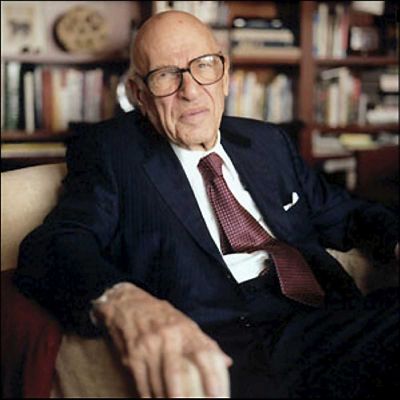

In 1950, William Ruane, or Bill Ruane as he was known, took a course on value investing taught by Benjamin Graham and David Dodd at Columbia University despite having graduated from Harvard Business School. One of his classmates was Warren Buffett, with whom he formed a friendship. Years later, when Buffett dissolved his investment partnership, he recommended that any partners still interested in value investing put their money with Ruane, who had launched his own firm, Ruane, Cunniff. The flagship value investing vehicle of the new firm was the Sequoia Fund, an open-ended mutual fund. Over the next 38 years, the Sequoia fund outperformed the S&P 500 by compounding at 15% per annum versus 13% for the broader index.

Walter Schloss, a legendary value investor who learned directly from Benjamin Graham, the father of value investing, never graduated from college and was hired as a runner on Wall Street in 1934, at the age of 18. Schloss enrolled in the New York Stock Exchange Institute, where he took courses from Benjamin Graham on how to value businesses, find value stocks, and manage money. Using the lessons he learned there, Schloss launched his own value investing fund in 1955, with a starting balance of $100,000, eventually growing to manage money for as many as 92 investors. For more than 50 years, he earned a 15.3% compounded annual rate of return, turning a $10,000 initial investment into $12,344,268, far outstripping the 10% return offered by the S&P 500 during the same period, which would have resulted in only $1,173,909.

In addition to penning several of the most important value investing books in history, Benjamin Graham, the father of value investing, was one of the two partners in the Graham Newman Corporation, the investment fund through which he put money to work. It was at this firm that Warren Buffett worked early in his career, learning from the master. As he amassed an astounding investing record, Graham divided his portfolio into several categories, or “operations”. These served value investing students well for more than seventy years and some still have value today.

Citing data provided by Vanguard, one of the premier mutual fund and 401(k) providers in the world, The New York Times recently reported that 60 percent of 401(k) accounts now have more money in them than they did before the stock market crash and worst recession since the Great Depression began two years ago.