Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

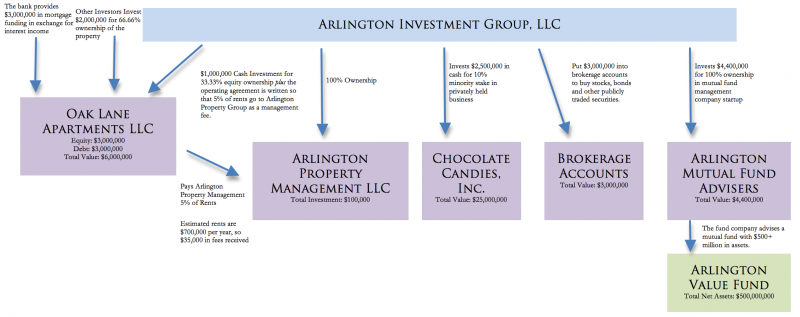

How a Holding Company Works A holding company is a special type of business that doesn’t do anything itself. Instead, it owns investments, such as stocks, bonds, mutual funds, gold, silver, real estate, art, patents, copyrights, licenses, private businesses, or virtually anything of value. The term holding company comes from the fact that the business…

Intelligence, knowledge, wisdom, discernment and good temperament are five distinct attributes a man or woman can possess. It is a common mistake to believe that they are interchangeable. They are not. Although they tend to be related, it is possible to have one without the others. How they interact with one another can determine the…

We finally got a few of the other Carl Barks collection framed for the office walls. I’ve been meaning to get pictures up for months and finally just decided to stop and do it. I was browsing auction records tonight so it reminded me …

Today, I wanted to write new content for Investing for Beginners at About.com, a division of The New York Times, and then go through the S&P stock sheets for fun.

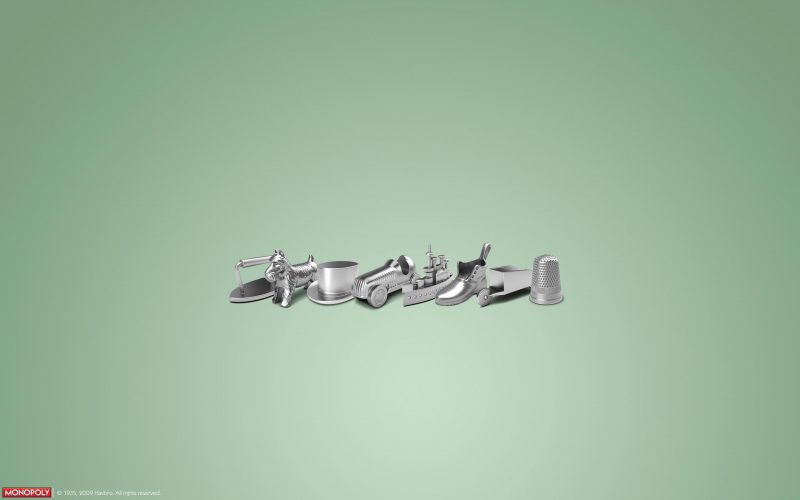

If you wanted to be as rich as Mr. Monopoly, how much would it take? How high would your annual income be? Your net worth? Those are the question that I pondered sitting at my desk this morning. Out of pure curiosity, I began to adjust the values of the Monopoly property rents for inflation, using the last full-year CPI figures (2009), knowing that the game was originally released in 1935.

I finished Atlas Shrugged a few hours ago. I loved it despite my not fully buying the philosophy of objectivism Ayn Rand espoused. I’ll discuss those criticisms in a future article. In nearly 1,200 pages, the single most important line to me sums up, in ten words, why I’ve been successful when so many others…

I’m going to prove that the average school teacher earns more money than Tom Cruise. No, seriously. In my article Exchange Your Best Efforts for the Best Efforts of Others, I was discussing the idea of Ayn Rand that money is a by product of virtue in a free society where no exploitation or theft…

Much of a person’s economic worldview can be understood by answering a simple question: “Do you believe that all men, regardless of actions, behavior or character, are entitled to housing, three meals a day, health care, and retirement security?”.

Given my two Wal-Mart inspired articles a few days ago, I thought this was germane. [mainbodyad]Wal-Mart is ending its profit sharing plan and upgrading it to include a $1,000 contribution to employee health care accounts so there is a greater cushion before workers have to pay medical deductibles plus moving to a system whereby they…

I had originally planned on reading today, then working on some detail work that needed to be completed but ended up heading over to the Country Club Plaza to go to the Apple store with my parents and sister. It turned into an entire day outing, which was wonderful. Here is my day in pictures.