Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

This mail bag speaks for itself. Joshua, I woke up this morning and expected to see something about the elementary school shootings. Why don’t you discuss current events more often? Anonymous By Request Earlier today, a 36 year old walked into an elementary school in Chenpeng village, Henan province, China, and stabbed 22 children with a…

After the apple pies I’ve been turning out, there has been demand for cherry pies of comparable quality given that everyone around here seems to prefer them. I do not have a cherry pie recipe, so I thought to turn to America’s Test Kitchen to find some of their suggestions. America’s Test Kitchen is one of my favorite…

Last night, I adapted the layered pudding Oreo dessert into pie form, making two Oreo pies, which are now sitting in the second refrigerator. It was the first, and only time, in my life I have ever used a pre-made pie crust dough but the goal is to develop a simplified recipe that anyone can make,…

If you have ever wanted a blueberry sauce recipe that will work with only four ingredients – water, sugar, salt, and fresh blueberries – packs a lot of sweetness, takes less than ten minutes to prepare, and can be used to garnish pancakes, drizzle on lemon cheesecake, top Belgian waffles, spoon over angel food cake,…

On this site, we strive to practice the philosophy of John Stuart Mill, who would eagerly read every side of an argument because he wanted to se that “no scattered particles of important truth are buried and lost in the ruins of exploded error”. That means we each have a fundamental, moral duty to openly…

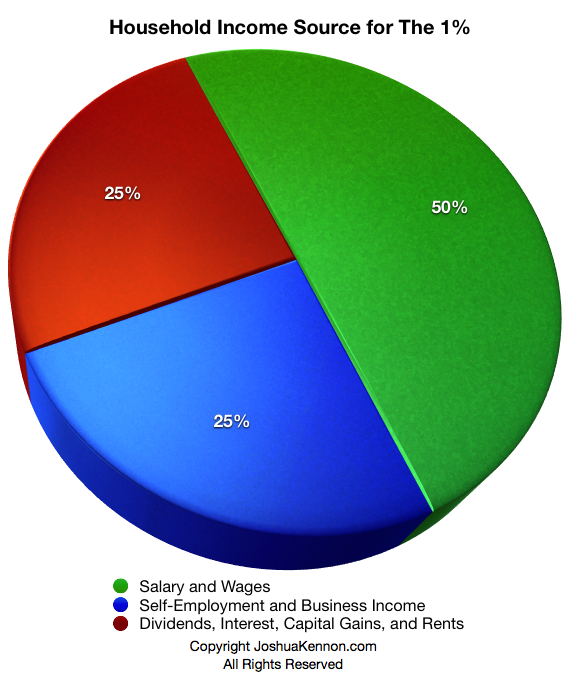

Earlier this year, The Economist did a nice write-up on a topic we discussed in depth back in 2011 in a post called “How much money does it take to be in the top 1% in the United States?“. Although the most recent data available is from 2008, applying a modest inflation factor, it seems…

In finance, there is a concept known as total return. The goal of total return is simple: To tell you what the overall results were to you, the owner, during a time period you held an asset. This includes any fluctuations in the liquidation value of the asset itself, profits produced by the asset and distributed to you as dividends, spin-offs from activity split off from the asset, etc.

I had some work to do but I just couldn’t focus. Still, I wanted to be productive. We had a giant bag of Granny Smith apples, butter, sugar, brown sugar, flour, and other ingredients left over from Thanksgiving, so I decided to mess around with apple pie recipes. The flavor turned out beyond my expectations.…

Going through the messages that are sent to me, a small percentage of you need to hear this. You have to take responsibility for where you are in life. You cannot control what happens to you – and sometimes terrible, horrible things do happen that you will never fully get over – but you can…

The Thanksgiving Dinner Feast Was Awesome As host to the family Thanksgiving dinner this year, we spent the 36 hours before the day itself sleeping off an on to get everything ready. The sheer amount of flour, white sugar, brown sugar, cinnamon, eggs, white wine, and heavy cream we went through was staggering. The counters…