Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

You may never look at raisins the same way again. The highest court in the United States just handed individual citizens a major win in terms of personal property rights, striking down one of FDR’s New Deal programs by depriving the Federal Government of a power it has illegitimately exercised for decades. The case was called Horne et al., v. Department of Agriculture. It stemmed from The Agricultural Marketing Agreement Act of 1937, which gave the Secretary of Agriculture authority to issue “marketing orders” for the purpose of maintaining stable markets in specific commodities.

On August 9th, 1995, the company behind Internet browser Netscape went public, skyrocketing as people fought to get a piece of the so-called “new economy”. It set off a buying panic among the public that lasted five years; otherwise rational men and women convinced that this time really was different, the mania feeding on itself. Anything and…

It is January 15th, 1919. You’re in Boston, Massachusetts shortly before lunchtime. Sitting at 529 Commercial Street is a three-year old tanker owned by the Purity Distilling Company, a subsidiary of United States Industrial Alcohol. At 50 feet high, housed within the steel body of this five-story behemoth is 26,000,000 pounds of sticky, sweet molasses; one of the most popular sweeteners…

With so much of my time spent away from the site in the past 4-6 weeks, I thought I’d give a “here’s roughly what’s been going on” round-up. I had intended for a lot of this to turn into their own stand-alone posts but this will be faster.

As time passes, ideas that were once unthinkable become mainstream. From racial equality to marriage equality, equal rights for women to voting rights for non-landowners, what issue do you think will be considered with abject horror in the future that we think commonplace today?

Now that we’re back from Chicago, I’m going to try to spend a few hours each day working on the blog upgrades we’re rolling out as part of Google’s new focus on mobile-friendly sites. With somewhere around 40% of the changes done on the backend, we’re reactivating the first of the cache tools today, combining it with the Cloudflare network to see if there are any conflicts.

After we said goodbye to Jimmy last night, we made plans to meet up again today for our final full day in Chicago. There was no real plan other than shopping on Michigan Avenue and getting a feel for Chicago. We were going to do a boat tour but the weather was too brutal. Next…

Eataly in Downtown Chicago Should Be Your New Italian Grocery Store After hours browsing the Thorne miniatures and the paintings, sculptures, and pottery at the Art Institute of Chicago, we were hungry. Jimmy wanted us to see a grocery store he thought we’d love called Eataly. He was right. This place is everything a grocery store…

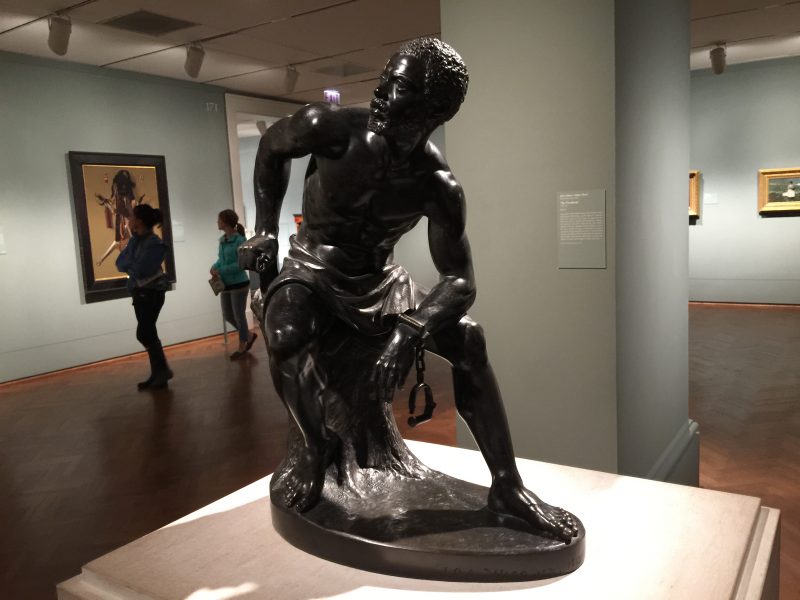

Remember back in 2012 when Jimmy came on one of his regular house guest trips to visit Aaron and me in Kansas City? The time when we went to the Kansas City Nelson-Atkins Museum of Art? Today, he took us to the Art Institute of Chicago. You already experienced the incredible Thorne miniatures installment in another post,…

Narcissa Niblack Thorne was born in 1882. She fell in love with her childhood sweetheart, James Ward, and they married. He was the heir to the Montgomery Ward fortune, one of the biggest in the world at the time thanks to a chain of department stores that were once as ubiquitous as Target or J.C. Penney. A graduate of art school, the Chicago socialite wasn’t content to sit around and make small talk all of her life. She began designing and orchestrating these incredible one-foot-to-one-inch scale historical replicas of different architectural, interior design, and furniture styles throughout history to serve as models of how homes and spaces had changed over the years. She was meticulous and insisted upon accuracy (e.g., the wood, down to the grain direction, of the tiny furniture had to be made in exactly the same way as the model piece upon which it was based.)