Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

I was asked, “There is a maxim of which you are no doubt aware that retail investors quote Warren Buffett, while professional money masters quote Jesse Livermore. You never talk about Livermore and I would like to know your thoughts on his philosophy.”

After dinner at Pierpont’s in Union Station, we made our way over to the symphony hall, arriving a few minutes before the orchestra took the stage. Tonight is a big departure from our usual Haydn, Mozart, and Beethoven. Particularly of interest to us were the second and third groups on the program. The second was Rodrigo’s Concierto de Aranjuez for Guitar and Orchestra, which was performed by Jiyeon Kim, a guitar virtuoso.

Aaron’s mom hadn’t been to the symphony here in town since the new performing arts center opened so we decided to take her to dinner and a performance. I completely forgot it was tonight because I started my first Korean drama in two months a few days ago and had scheduled some time to watch…

You need to read this magnificent article in The New York Times that breaks down the economic phenomenon we went over several years ago when we looked at the work of Harvard Professor Charles Murray, who demonstrated that a significant driver of income inequality in the United States was caused by a radical shift in the…

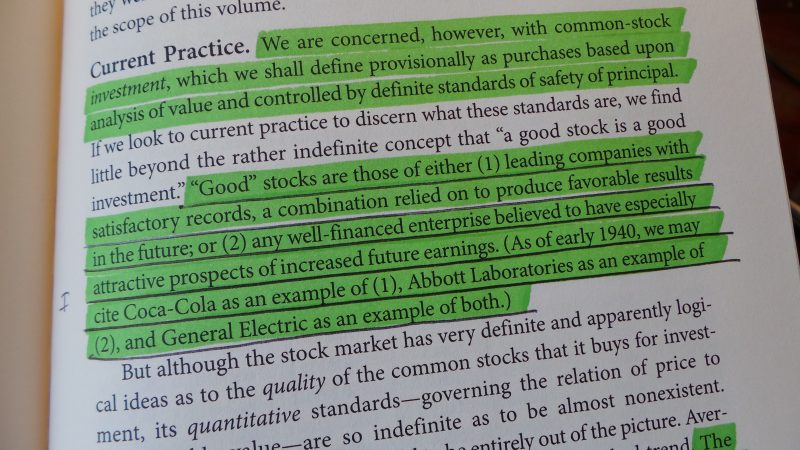

There are a handful of books I re-read to refresh some of the timeless lessons I think are important. One of them, which you can probably tell from some of my recent posts, is Security Analysis. I recently started my way through the updated Sixth Edition, based on the 1940 text, and the clarity of thought never ceases to amaze me.

We talk so often about the divide that is slowly happening in the United States as a result of socioeconomic forces. I did a double take this afternoon when I came across the front page of The Wall Street Journal involving a story based on this reality. It has a profile detailing how vastly different life experiences…

I’ve been browsing real estate all day for a project that needs my attention. I ended up wandering from community to community, and at one point, clicking on random states. I somehow came across what has to be the ugliest piece of property I’ve ever seen in my life but now I can’t look away. I’m fascinated.

My youngest sister made our day yesterday by stopping by the house to visit for a few hours. She had been at the NakaKon convention in Overland Park and saw an 8-bit pixel Metroid collectible she thought I’d love. She was right. Upon holding the specimen, I temporarily reverted to a six year old, 1980s-living, NES-dominating beast. Behold, and listen to the theme if you need some adequate inspiration.

The word Mokita is a fantastic word taken from a language called Kivila. It is spoken in Papua New Guinea. The best English translation you can get of Mokita is, “the truth we all know but agree not to talk about.” There are several concepts in the English language related to the notion of Mokita, such…

Tesla Motors, the Silicon Valley-based electronic car company that has revolutionized energy efficient vehicles and become a cult icon, operates its business like Apple. It designs amazing products, then sells them direct-to-consumers through specialty branded stores, staffed with knowledgeable sales associates. By cutting out the middleman, Tesla can pass more savings on to the consumer,…