Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

Some of you who write me need to understand something or you are going to have a lot of disappointment in your future. Just because you are smart, just because you have talent, doesn’t mean anything. Your business, your career, your efforts can be left in the dust by someone who is driven to succeed,…

Is the TempurPedic GrandBed worth the price? Do Aaron and I still recommend and love it?

A year ago, I posted a picture of my younger brother secretly flying to Colorado to propose to his girlfriend. Now, after 24+ hours in which we had a rehearsal, rehearsal dinner, photo shoot, ceremony, and reception, I am beyond thrilled to say that he and Tara are married! Both Aaron and I adore her;…

I was reading a film review by actor James Franco of the new Superman movie, which I saw at the midnight premier right before I hopped on the flight out to California for the weekend. My family wanted to go, and I’ve always like Henry Cavill’s work since the adaptation of the seminal work of Alexander Dumas, The Count of Monte Cristo, so I thought it would be fun. When we were in the theater, the talk turned to the actual character of Superman.

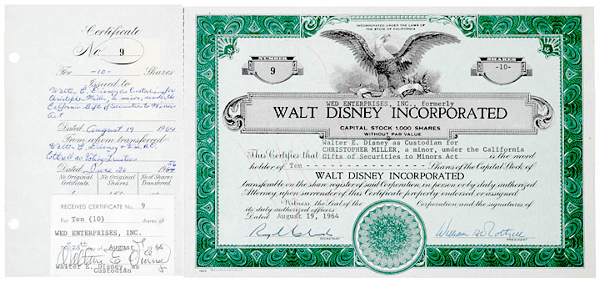

In the past week, we’ve talked about the phenomenal success of an investor who bought shares of Walt Disney Productions (now called The Walt Disney Company), a decision that would have turned a 1,000 share position costing $13,880 into somewhere between $26,672,640 and $40,000,000 between 1957 and 2013. We even looked inside the secret family holding company, WED Enterprises, Walt Disney used to build his own family’s wealth and retain power. Most people don’t know that before those two firms, there was another that changed the direction of Walt Disney’s life. It did not enjoy a fairy tale ending but it did lay the foundation for the things that came much later.

After our discussion of The Walt Disney IPO earlier today, which was born out of Walt and his family consolidating three of the companies they owned underneath a single umbrella and issuing shares to the public to help finance the ever-expanding empire, including the creation of the Disneyland theme park in Anaheim, California, I thought it…

With the talk of investing in Walt Disney shares as part of my souvenir program during my weekend trip to Disneyland in California, I thought it would be fun to go back and do a case study of the Walt Disney IPO. I originally got the idea the last time we were in Walt Disney…

It is now Tuesday. We flew home yesterday and let me say the John Wayne Airport in Orange County is beautiful and well-run. The plane flew out over the Pacific Ocean and then banked back, parallel to the coast line, so we got the most amazing view. And I’m not sure what happened while we…

After breakfast at Steakhouse 55, we jumped on the monorail and went to the Magic Kingdom to enjoy our last day in the park. We flew out here on Friday and it’s now Sunday, so we will have to go back tomorrow. While Aaron was still getting the…

We all met for breakfast at Steakhouse 55 in the Disneyland Hotel this morning. We were both starving because we hadn’t eaten in 24 hours – there was so much food at Club 33, neither of us were in the mood for anything else and couldn’t bring myself to even have a snack by midnight. This…