Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

In some ways, I am my father’s son. In other ways, I take after my mother. When it comes to travel and an affinity for technology gadgets, I definitely take after mom. In fact, in these two areas, my dad and my personalities are so far apart, it is almost comical. It rarely comes up now that I’m an adult with my own family, but occasionally, we are involved in a joint project of sorts that requires us both to be in a city. This happens to be the case this morning and booking the trip was like Iran and Israel trying to agree over peace terms, only a lot friendlier.

This weekend, I traveled several hundred miles to visit one of my grandmothers, who hosted a family dinner. On the drive, we went through some extremely poor communities; places where a family of four or five might live in a $22,000 house. This caused me to think about poverty for the past couple of days.…

When Peter Lynch was 33 years old, he was put in charge of the obscure Magellan fund, which had $18 million in assets. This was 1977, so today that is about the same as $63 million. The amazing thing about Peter Lynch is, it would have been effortless for him to raise billions of dollars…

I was reading an argument earlier about how Europe needs a “Lehman Brothers moment” to scare the member nations into swift action. It reminded me of one of my favorite passages from Barbarians at the Gate that discussed the merger of Lehman Brothers and Shearson.

If you were going to take a family vacation, you would never just get in the car and start driving, picking random turns at intersections. If you did, you would be lucky to end up anywhere meaningful. The chances of stumbling upon a Disneyland or New York would be remotely small. Instead, you decide where…

With the season premier of True Blood upon us, I began thinking about how lessons on life, money, and success are all around us if you just pay close enough attention. If you understand how compounding works, it is so easy to get rich if you have enough time. Consider Sam Merlotte, the Bon Temps bartender and resident landlord. His character is around 30 years old, give or take several years, when the show began.

It’s a fairly consistent thing that I get messages asking about the morality or ethics of investing in a certain type of company. Right now, there is a mail bag response I’m working on that deals with this topic. We’ve also talked about the fact that the Bri Institute thinks Jesus hates my portfolio. Though,…

I once read somewhere that you should measure the success of your day by the seeds you plant for a better future. Over time, you keep planting, your life radically changes for the better. I came across a perfect illustration of that concept through a bit of serendipity.

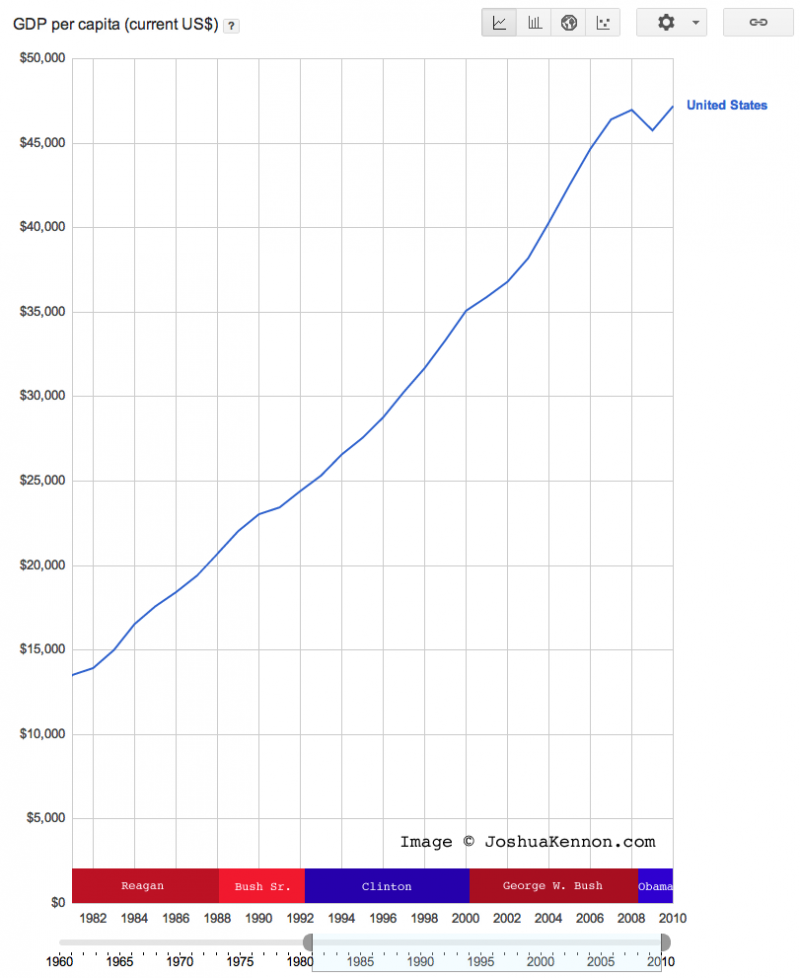

As we approach my 30th birthday, I thought about taking a look at what has happened to the economy of the United States in the three decades I’ve been alive to gain a sense of perspective about where we have been. This is the time period during which I went from childhood to adulthood, and…

I went to the Nelson Atkins Museum of Art in Kansas City to see the new Rodin exhibit with Aaron and Jimmy. You already know Aaron, but Jimmy is a mutual friend from college. I had a fantastic time, especially in the 17th, 18th, and 19th century furniture exhibits, for reasons that will be no…