Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

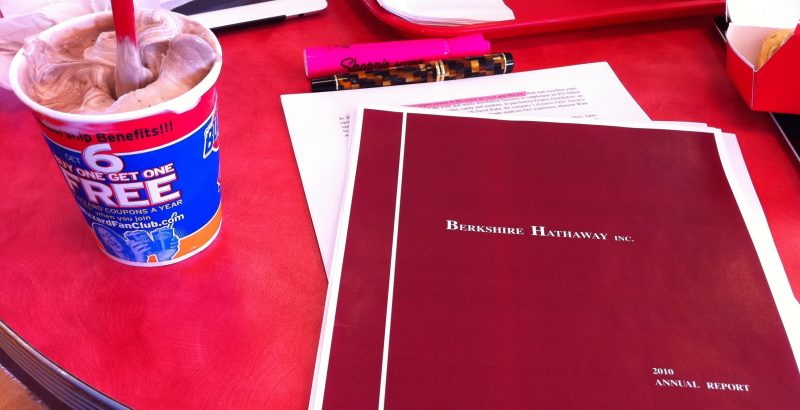

Berkshire Hathaway shares are now trading at around the lowest valuation relative to earnings and assets that they have since the dot-com bubble in the late 1990s. How is that possible? As the famed holding company of Warren Buffett has added businesses such as Burlington Northern Santa Fe, the stock price has treaded water so each dollar invested at today’s price represents more profit and equity than it did in the past.

Let me tell you something – no matter how rich you are, no matter how much stuff you can afford, no matter how successful you become – there is no better feeling than a completely random, awesome surprise that you aren’t expecting that comes from nowhere out of left field! It’s the grown-up equivalent of…

I am convinced that the Series I savings bond program remains one of the most underrated investments for the average American in history. So much so that I wrote tens of thousands of words on the topic over at my the Investing for Beginners site. But tonight, I was writing a new piece of content…

Dinner tonight consisted of bow tie basil pesto pasta. The recipe included pine nuts, garlic, fresh basil leaves, parsley, extra-virgin olive oil, salt, Parmesan cheese, and farfalle. It was very good; we both enjoyed it a lot. I imagine it would even be good cold in a packed lunch, but that is just a hunch.…

Tonight, I reorganized the master bathroom at home and came across several bottles and products of Brut. The company, once a luxury brand, has become one of the cheapest two-buck-chuck colognes in the United States and sells for a couple dollars at Wal-Mart. Although I’m normally known for my obsession with high-end fragrances, even going so far as to special order scents from overseas and paying hundreds of dollars per ounce just to sample a new perfume house offering, this infamous brand still sits proudly on my shelf along with the most expensive and exclusive fragrances in the world. Why? Because it reminds me of my grandfather. It was his cologne of choice and the moment I smell it, I’m instantly transported back to my childhood.

You all just love writing me about this topic, don’t you? Wow. Okay. I’m going to use it as a way to explain how I process business strategy and investing decisions, too, though because, frankly, that is what I’m in the mood to talk about right now and I can introduce you to the idea…

After meeting my newborn nephew for the first time, Aaron and I went to grab lunch at Houston’s steakhouse on the Country Club Plaza. We had planned on going to Ruth’s Chris but everyone else was too exhausted so just he and I headed over to the shopping district because we wanted to look at…

There is a story told by Dr. Harry Emerson Fosdick that is a perfect lesson for happiness and success in life: On the slope of Long’s Peak in Colorado lies the rum of a gigantic tree. Naturalists tell us that it stood for some four hundred years. It was a seedling when Columbus landed at…

Ruby and I were having a conversation about religion in the United States today and I find it incredibly interesting that there is a small, cultish group of “Christians” (for lack of a better term) that are really nothing more than the modern day resurrection of the ancient Babylonian pagan cults. They are so ignorant…

When the United States was founded, life was not paradise as everyone seems to think in some sort of collective delusion. In fact, for all of its faults, America is far superior today to what it was in the past, even with our current fiscal problems. Consider that when the nation was founded: Women could…