Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

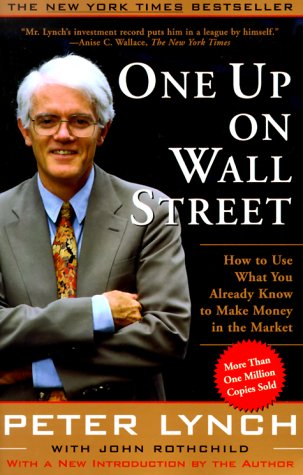

At the time it was published by the most successful mutual fund manager of all time, Peter Lynch, One Up on Wall Street was considered pie-in-the-sky by some because it was addressed to the average investor who wanted to select individual stocks for a portfolio, recounting wildly successful investment strategies. One Up on Wall Street was…

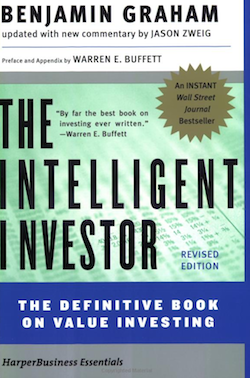

The Intelligent Investor is the portfolio management book written for the masses, made famous, in part, by the fact that it was what attracted legendary investor Warren Buffett to study under author Benjamin Graham at Columbia University. There are several different versions, updated to reflect the time in which they were published, all offering unique…

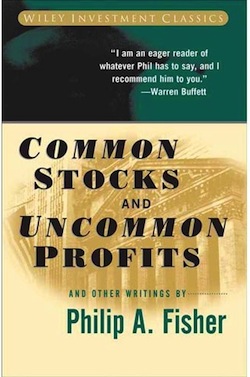

In 1958, one of the most influential investors in history, a man by the name of Philip A. Fisher, published his masterpiece, which you can still get today. Unlike virtually all other voices in the financial markets at the time, Fisher proposed that an investor should find a handful of really high quality firms, pay…

I finally have it – Scrooge McDuck’s Evening Adventure is mine! After more than 9 years of waiting, searching, and trying to find it, again, it is mine!

I don’t talk about my personal life often, but the few times things do come out about my past, it should not come as a surprise to know that my younger days were filled with something known in American cuisine as “soul food”. Big, black cast iron skillets on a stove, with bacon fat drained off to save money, to be reused during cooking. Fried chicken. Sun tea. Coleslaw. Cornbread. It’s the type of food that got poor folks by in the Great Depression, that was made in the farmhouses and back swamp shanties before Social Security was established. It’s cheap, made with what is abundant, and took centuries to perfect. It was the United States’ answer to the so-called Peasant Dishes of France.

Our Favorite Recipe for Blacked Chicken with Sun Dried Tomatoes with Romano Cheese, Cream, and Butter Sauce Tossed Into Fettuccine Noodles A couple of nights ago, we tried another recipe adapted from the famous Marcella Hazan Italian cookbook. It involved a cream and butter sauce, and was one of the original versions of Fettuccine Alfredo…

This McDonald’s case study looks at what a $100,000 investment in the restaurant’s common stock would have turned into over a 25 year holding period. It is one of my favorite investment research projects because there are four possible outcomes depending on how you behaved with your shares. It illustrates the importance of finding a…

A Case Study of Eastman Kodak How the Bankruptcy of One of America’s Oldest Blue Chip Stocks Would Have Turned Out for Long-Term Investors One year ago, Kodak declared bankruptcy after more than 130 years in business as a leading blue chip firm that gushed profits for its owners. I wrote Kodak’s demise at the…

It’s been 1-2 years since we talked about the intrinsic value of Berkshire Hathaway. The last time I publicly commented in any meaningful way was to say that I thought Morningstar was wrong in its model. This put me in the interesting position that rarely happens: I thought intrinsic value was higher than the analysts who were publicly writing about it. Normally, I’m the one exclaiming that the estimates and variables used were too rosy.

In the 1920s and 1930s, a banker named Pat Munroe in the small town of Quincy, Florida noticed that even during the depths of the Great Depression, otherwise impoverished people would spend their last nickel to buy a glass of Coca-Cola. With good returns on capital, and a once-in-a-century valuation so low that the business was trading for less than the cash in the bank, “Mr. Pat”, as he was called, encouraged everyone he knew to buy an ownership stake in the firm. He would even underwrite bank loans, backed by Coca-Cola stock, for his responsible depositors to encourage people to acquire equity.