Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

From August 2008 to June 2013, David Danon was an associate attorney in the tax department at the Vanguard Group. According to a whistleblower lawsuit filed with the State of New York, which served as the basis for additional whistleblower actions filed with the State of Texas, the State of California, the Securities and Exchange Commission and the Internal Revenue Service, Danon was silenced, and ultimately sent packing, after he persistently warned management that Vanguard was committing massive tax abuse by using a combination of legal entities and improper pricing structure; an arrangement that went back 40 years. Danon claims that others who had raised similar concerns had also left the firm after facing a backlash for refusing to toe the line on what they believed was illegal behavior.

One of the major themes running through my body of work, both on this site and at Investing for Beginners, can be summed up in the statement, “Know your risks”. I hammer it home all the time; “risk-adjusted return”, talk about remote-probability events, explaining how much of wealth building is learning to “tilt probabilities in [your] favor”, admonishment to never invest in something you don’t fully understand and couldn’t explain to a Kindergartener in a couple of sentences. Consider this real-life tragedy a morality tale that can help you protect your own family.

Those of you who wish to read my writing at Investing for Beginners can now navigate my body of work much more easily thanks to a directory I built over the past week. It’s a productive copy for my own internal use as part of a planned upgrade project I’ll be doing in the coming year (as such, it…

Throughout your life and career, you are going to face many situations in which you are dissatisfied. Often, these situations will arise because of legitimate grievances you have about a person, behavior, policy, or system. There are a few strategies that, used judiciously, can exponentially increase your effectiveness.

After making the rum raisin ice cream recipe, we decided to try our hands at a white chocolate ice cream recipe, which used whole eggs (rather than egg yolks), a 1/3rd increase in the heavy-cream-to-whole-milk ratio, left out the brown sugar, granulated sugar, and salt, and a few other tweaks in terms of the order in which the ingredients were assembled.

I’m not sure what it was but a few nights ago, I had an overwhelming urge to begin planning our meals for the next two months, a big part of which I wanted to feature older recipes that don’t get their due. This autumn and winter, we’re going to cook like it’s 1700 – 1950; Shepard’s pie, German Christmas cakes, Yorkshire pudding, perhaps an Apple Dowdy from Colonial America. I want to go back and make things that get most of their flavor profile extracted from a handful of key ingredients; fruits, nuts, meats, liqueurs, or spices. Rum raisin ice cream was on that list.

Alex asks, “What are your thoughts about periods when overall stock market valuations look very high. Should people not buy, or should people even sell? It seems like today is a time when most valuation measures show the U.S. market at extreme highs relative to history. What are your thoughts?”

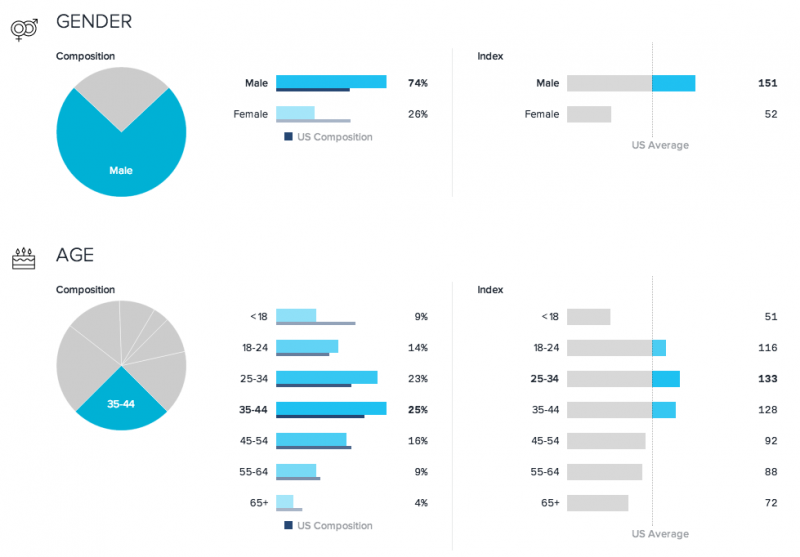

It’s time for our annual review of the blog community demographics! Actually, I hadn’t realized it since we’re busy launching the global asset management firm but a few of you sent me messages asking where it was so I wanted to take some time out to get the latest numbers up for you. The short version: Continuing the usual trend of winning, it will likely surprise no one that, since last year, you’ve managed to grow a bit older, mostly richer, and better educated. When people talk about the top of the socioeconomic bell curve, they are speaking about many of you. This community is extraordinary.

One of the major lessons I’ve tried to teach is that building your net worth comes down to two levers: Cash in and cash out. That’s it. That is the entirety of the game when you peer past the distractions and gaze into the heart of the mathematical reality. From a financial perspective, every action you take for your career or business ultimately only matters in so much as it someday serves to exert force on one of those levers so that more cash is flowing in than is flowing out, leaving a surplus. It sounds so simple but when you see things through the focus of this particular lens, you can more quickly identify the actions that are likely to have an outsized effect, both for good or bad, on net worth.

I did not realize I needed a miniature Boeing 747 in my life but I now know that I do. I could get it painted with the UPS logo for the investing cabinet which, I suppose, would need to be renamed the investing hangar. (Aaron and I don’t hold any meaningful stake in United Parcel…