Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

The Night Black Wall Street Burned to the Ground When I became obsessed with investing as a child, convinced it offered me the greatest probability of escaping what I saw as an economic dead end due to the community in which I lived, I spent years reading everything I could about any and every event…

We’re at home wrapping presents, baking cookies, and getting ready for the family dinners that are coming up in the next couple of days. Since Aaron and I are gifting stock this year – almost all of the transactions were completed yesterday with a settlement date of the 26th – there isn’t a lot left for us to do. However, to give the kids something tangible they can open under the tree from us, we went and got industrial size boxes of their favorite candy along with an explanation of how their stock in The Hershey Company is going to work.

The average healthy adult should eat roughly 2,000 calories per day to maintain a recommended weight. In the United States, all else equal, the average male, at 5’8″, should weigh between 140 pounds and 172 pounds. The average female, at 5’4″, should weigh between 114 pounds and 151 pounds. In study after study, the typical person underestimates…

A friend of mine, a nuclear engineer, once explained that he doesn’t bother to contribute to forums or message boards when the topic of nuclear energy is brought up anymore because people are irrational about it, interested in their own confirmation bias rather than learning or having an honest discussion. Almost everyone I know working in…

[mainbodyad] With all of the talk of gas prices falling, I’m reminded of the situation a couple of years ago when fuel costs were on an upward trajectory. Everyone from the little old ladies at church to major economic commentators were lamenting the “record high” energy expenses. Very few people noticed that, as per the U.S. Energy Information…

We’re making Christmas candies, chocolates, and cookies as part of our gift strategy this year. I’m probably most excited about trying my hand at the Jacques Torres Nougat Montilimar, which is going to require a deft hand.

Ten or eleven years ago, I went to a steakhouse in Omaha, Nebraska during a trip home from college. The chef that day had decided to make either a brandy or cognac reduction sauce using the drippings from the beef. Feeling adventurous, I decided to order off menu and see what it was like. The word incredible doesn’t even do it justice.

As we approach the end of 2014, I’m looking back on the year. One of the major changes from an investing perspective what a modification Aaron and I made in the investment policy manual. That doesn’t happen often. We added a handful of companies to the list of permanent business; those companies we consider so…

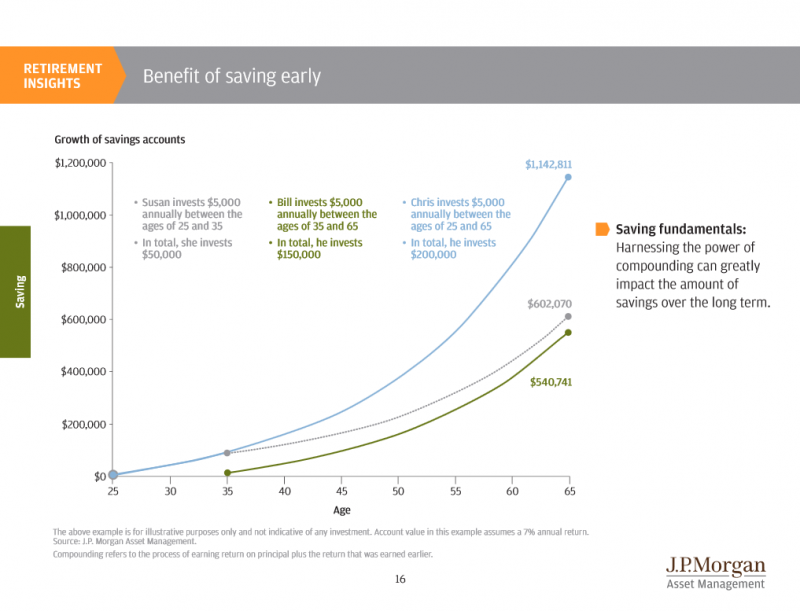

I’m putting together a retirement portfolio for several people I know. One of them is proving to be a fun intellectual exercise. Essentially, the mandate calls for me creating a ghost ship of a portfolio that, once it has set sail, will drift almost untouched for the next 30+ years when it will be gifted to the children at the end of the life expectancy of the owner. Beginning in 7 to 10 years, the owner will start taking 3% to 4% distributions to augment an otherwise secure retirement. The portfolio is to be allocated 70% to a collection of 70 to 100 blue chip stocks, 25% to high-grade bonds, and 5% to cash or cash equivalents.

I mentioned yesterday that I baked a caramel pecan apple pie. We had some surplus homemade pastry dough and granny smith apples from the two granny smith apple pies I made on Thanksgiving, using my favorite apple pie recipe. I wanted to try something different, and needed to find another apple pie recipe that didn’t require a top crust as I had just enough to cover the bottom of a pie pan to use the leftovers. I began the search, ultimately settling upon a perfectly rated derivation from a publisher called Taste of Home.