Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

I found some of our old tax filings from last decade! It turns out that around our college days, living together in the apartment complex next to the Quakerbridge Mall in Princeton, New Jersey, our combined household income was somewhere between $80,000 and $100,000 even though neither of us had full-time jobs and we were both students attending school on music scholarships. (This is the same apartment that I showed you a few months ago.) The difference between the two figures depends on whether you count unrealized capital gains as “income” since our net worth was increasing but it didn’t reflect in our taxes at the time.

This upcoming week is going to be busy. I have to finalize the accounting approval for last year before sending off all of the records to the firm that prepares our taxes, I have to drop off the finalized terms contract for the attorneys that are helping me explore launching my own financial vehicle, I have to write two or three new pieces of About.com content, I need to continue studying CSS because I love it, and I have to work on a lot of other stuff that you probably don’t really want to hear about – I’d like to get through the technology sector annual reports, finalize the list of stocks I plan to buy through my pension plan once the upcoming contribution is finalized, etc.

Years ago, I vaguely remember hearing someone comment that it was interesting how differently we measure wealth today compared to British society at the end of the 19th century. This made me realize that most people don’t even know there is a difference; that there are primarily two ways you can think about measuring your wealth and which you choose for your own household will influence how you behave, the capital structure you employ, and even how you think about risk.

I started thinking about people who lose everything, or what Charlie Munger calls returning “to Go”, as in the Monopoly board. Once you are rich, your primary motivation shouldn’t be to get richer, it should be to avoid wipeout risk, or returning to go. But as a training exercise, I decided to contemplate what I would do if I woke up tomorrow and the last ten years had been a dream. What would my first course of action be to rebuild until I got my financial affairs in order?

One of the most common questions I receive is, “how do you come up with a list of stocks for your portfolio that you then research further?”. Here is a brief overview.

The single most important line in the President’s State of the Union speech to Congress last night hasn’t gotten a lot of attention. Here it is: Over the next ten years, nearly half of all new jobs will require education that goes beyond a high school degree. And yet, as many as a quarter of…

As the American Civil War dawned, William Tecumseh Sherman, the man who was to be called the “first modern general”, remarked to a Southern friend: You people of the South don’t know what you are doing. This country will be drenched in blood, and God only knows how it will end. It is all folly,…

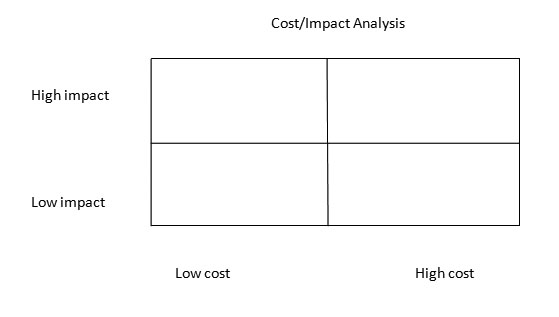

There are a lot of things you can take from corporate America and apply to your personal life. One of my favorites is a cost/impact analysis. If you are having difficult sorting all of the work and projects you need to finish, one way to make the decision easier is to draw a box and…

A $1.00 bill in 1971 has the purchasing power of only 18¢ today. A £1 bill in Great Britain has the purchasing power of only £0.09. That is, if you put money in a coffee can in 1971 and buried it in the back yard, you’ve lost 82% of your purchasing power in the United…

In an interview called “JK Rowling: A Year in Her Life”, that covered the period during the last year when she finished the final Harry Potter book, the interviewer asked Rowling, “How would you like to be remembered?”. Her response was poignant. As someone who did the best she could with the talent she had.…