Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

On April 11th, 1823, Thomas Jefferson wrote a letter to John Adams. In the private correspondence, the man generally regarded to be one of the three most brilliant founding fathers confided to his fellow founder and former President, “And the day will come when the mystical generation of Jesus, by the supreme being as his father in the womb of a virgin will be classed with the fable of the generation of Minerva in the brain of Jupiter”.

Countless Americans mistakenly believe that the constitution says we are a nation, “of the people, by the people, and for the people”. Though it’s a nice sentiment, many don’t realize that the line came halfway through the nation’s history in the Gettysburg Address by President Lincoln and isn’t part of our constitutional framework at all.

I happened to re-read some of Justice Scalia’s opinions tonight and in his Evans dissent, Scalia stated, “Since the Constitution of the United States says nothing about this subject, it is left to be resolved by normal democratic means”. This sentiment embodies a fear that founding father Madison believed was inevitable – that someday, someone would come along and convince people that only those rights listed in the constitution were constitutional rights.

In 1953, a great movie starring Lauren Bacall, Bette Grable and Marilyn Monroe was released called How to Marry a Millionaire. I got curious as to how much money it would take to equal the same net worth today so I did an inflation adjustment because I wanted to know how big their motivation was in the film.

I finally got through the ruling from Judge Vaughn Walker in Perry v. Schwarzenegger which overturned Proposition 8 as unconstitutional and it is scathing. I have never read anything worded this strongly other than Scalia’s dissent in Lawrence v. Texas where you could virtually hear the man shrieking with fists flying (and I say that having tremendous, enormous respect for Justice Scalia’s intellect, which at times, soars to the level of an apostle preaching legal gospel).

Bizarre but true results of several recent studies on human behavior: Turns out, women have no clue that a vast majority of men regularly consume pornography even while in relationships and religious affiliation increases the per capita consumption of pornography, perhaps due to the forbidden fruit aspect of repression. Furthermore, the more pornography available to citizens, the more drastically rape cases decline. The findings shocked the researchers behind the studies.

Mental Model: Goldovsky Errors How can a dead body hang in a tree for nearly 14 hours and not be noticed by a town? How can experts at one of the world’s top scientific institutions miss an easy-to-spot mistake for almost 30 years yet a 5th grader spots in 2008 after only a few seconds? …

Mental Model: The Dunning–Kruger Effect Have you ever wondered why some people come to erroneous conclusions despite all the counter evidence, overestimate their abilities, and constantly make mistakes whereas other, more intelligent people often claim ignorance and throw things on the “too hard” pile? The reality is that not everyone in a given population can…

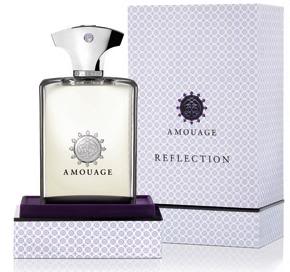

As I mentioned in the Amouage Jubilation XXV review yesterday, one of the Amouage fragrance samples we received from the company, which is the official perfumer to the King of Oman in the Middle East, was Amouage Reflection for Men. I said that if the Jubilation XXV was the King, then Amouage Reflection was the…

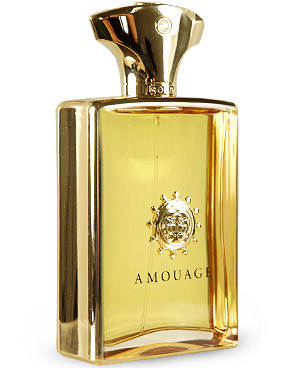

Today, the postman came bearing gifts; specifically, the package of fragrance samples I bought from Amouage, the official perfumer of the King of Oman in the Middle East. They shipped from the retail boutique in London via Royal Air Mail and arrived far sooner than I anticipated. My family came over and we broke out…