Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

Last week, Simon Cowell’s new show, X-Factor, called one of my companies, Mount Olympus Awards asking if we could outfit the varsity jackets for Marcus Canty’s performance of Bobby Brown’s hit “Every Little Step I Take” on tonight’s live show. Most of the time, letterman jackets with custom chenilles take 4 to 6 weeks, but…

This Halloween evening, I am sitting at one of the desks in my home, drinking a cup of Costco coffee, and penning About.com content for the Investing for Beginners site. I’m going to try and pre-write the next few months’ worth of articles and set them to automatically publish themselves due to the upcoming time crunch…

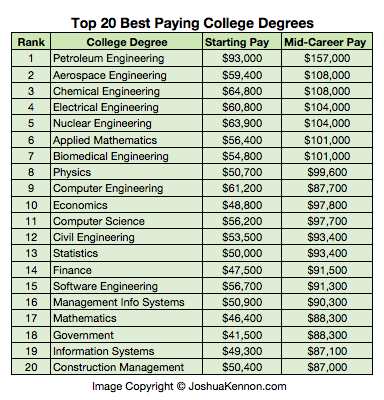

Yesterday, we took a look at the worst paying college degrees. Today, I want to look at a list of the best paying college degrees. It is clear that, like all things in a free society, supply and demand determine payoff. Engineers rule the day when it comes to making a wise investment in education,…

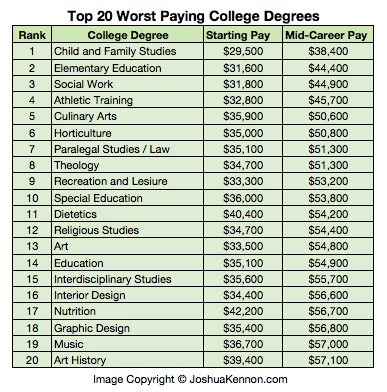

You know I’m a big proponent of following and monetizing your passion. If you want to be an artist, you should be. If you want to be a social worker, you should be. The key is, you make that decision knowing what it entails. The probabilities are substantial that you are not going to make as…

Earlier this year, I was watching Gossip Girl and suddenly the characters on screen were wearing varsity jackets. I immediately called the office and demanded to know why we hadn’t been the one that made the products. The response? “We were.” There have been a few other moments like that in the past couple of months…

Mental Model: The Hundredth Monkey Effect In social evolution, there is a mental model that describes the moment that knowledge, behavior, or belief reaches a tipping point (when the “100th monkey” is added), and instantaneously spreads throughout society so that it reaches the rest of a population without being taught, becoming common. The original research…

Yesterday, I explained how most of the people in the Occupy Wall Street protest haven’t yet realized the struggle isn’t between the rich and the poor – it is between the knowledge workers and manual workers, which Peter Drucker predicted in startling detail decades ago. Charles Hughes, a professor at Henderson State University, had…

I’m going to let you in on a secret. It’s not much of a secret for those who study economics or pay attention to the world. In fact, it’s been known for some time except to the average guy on the street, who is busy living his life and supporting his family. He thinks the…

Mental Model: The Thief Among Us One of the things that has perplexed me for a long time is Charlie Munger’s insistence that a significant minority of humanity is wired in such a way that they will steal if given the opportunity, regardless of whether or not they need the resources they are taking…

We already looked at how much money it takes to be in the top 1% of wealth in the United States. Now we are going to look further into the top 1% of wealth. This category, those who have between $5 and $10 million in investments, has been called by some The New Elite. Personally,…