Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

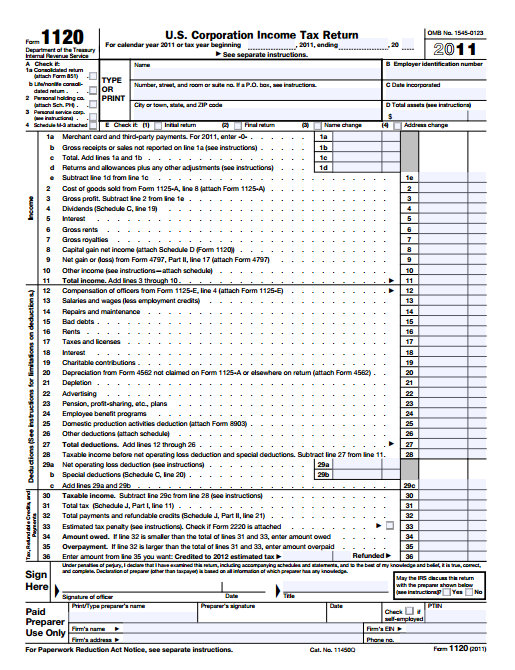

There has been a lot of talk over the past few days of corporate inversion. Corporate inversion happens when an American company changes its domicile to another country by merging with a foreign entity. Inversions have been occurring at a rapidly accelerating rate. Pfizer attempted one of the largest inversions in history with the AstraZeneca merger that…

This May will be 10 years since Aaron and I graduated from university. I just looked up the cost for the upcoming academic year, which includes tuition, room, board, fees, and books, and it’s running at a rate of around $53,000 per annum. Assuming even modest annual increases, a 4-year degree would cost just shy of…

I normally like richer, specialty breads – the heavy kind you find in some European bread shop, each for its own purpose and recipe – but a recent trip to the grocery store made me curious about the type of ordinary bread most Americans are eating. After looking at the nutrition label of several major baking companies,…

From time to time, I get messages from business owners or entrepreneurs who are discouraged and upset. Their family, friends, colleagues, bank officers, or suppliers don’t believe in what they are trying to do and they take it personally. This afternoon, as I sat in a McDonald’s restaurant having coffee and revisiting an excellent book called McDonald’s Behind the Arches that details the historical rise of one of the world’s largest real estate portfolio masquerading as a hamburger chain, I was reminded of a story I first read back in college that I think has a lot of powerful lessons.

We have been trying new recipes, again. One of the dishes that was on the list was a skillet lasagna. It’s popular because you can take ingredients you have at home and quickly put together a home cooked meal without a lot of effort. I was hesitant because, in my opinion, the entire appeal of…

It is a common mistake for inexperienced investors to look at the realized or unrealized gains or losses reported by their broker, using it as a proxy for economic reality. Total return, particularly on an after-tax basis, can be wildly different. Here is one real-world illustration of how the difference may arise.

After my post on The Fresh Prince of Bel Air earlier, I began thinking about the media industry. One of the things I find most fascinating when studying history, businesses, mental models, and the human experience, is the unexpected cultural phenomenon. There are certain things that happen, at certain moments in time, that are only…

La Marche des Scythes I’m working from my home study trying to get a bunch of stuff knocked off my agenda now that we are starting the 3rd quarter of the year but I have a certain passage from La Marche des Scythes in my head. I’ve been playing it on repeat at full blast…

On June 26, 2014, I beat my first Deity game in Civ 5. I decided to play a Highland map surrounded by mountains, huge, with maximum city states. Luck of the draw pitted me against Genghis Khan, who was never able to march an army to my capital in time due to the long, almost impassible mountains that stood between us.

My niece and nephew were over at the house a couple of days ago and I ended up playing Eurotruck Simulator 2 with them as I had picked it up during one of the past Steam sales. In it, you want to start a freight company but you have no money so you take driving jobs. As you amass capital, you establish your own trucking business, setup a headquarters, acquire new equipment, and increase profits. You can even program your radio to play your own mp3 files.