Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

It is done! The Thanksgiving dinner menu has been set (and a shout-out of heartfelt thanks to blog reader Andrew Brown, who corrected my calendar mistake and made me realize I had far fewer days to prepare than I thought). [mainbodyad]My week is booked with responsibilities for work, and the spouse also has a…

I’ve made no secret of my love of employee-owned businesses. If you want to find the best working conditions, the highest pay, the best employee benefits, and the most cohesive strategies, all else equal, you are going to find them working for a company that has no outside shareholders and is instead owned by the…

Mental Model: Mere Exposure Effect or the Familiarity Principle The mere exposure effect, also known as the familiarity principle, describes a phenomenon that causes humans to rate or feel positively about things to which they are frequently and consistently exposed, including other people. All else equal, you will buy products, invest in stocks, frequent establishments,…

It’s time for some mental model homework. It isn’t often that I read a news story that causes me to grieve. Yet, that is exactly what is happening with the revelations coming out about General Petraeus, the disgraced CIA director and former military commander who had to resign after it was revealed he cheated…

Feel good story for the day: Peyton Manning, the 36 year old legendary quarterback, bought 21 Papa John franchises in the Denver area a couple of weeks ago, according to Bloomberg. It looks like he is borrowing from the Jamal Mashburn and Ulysses Bridgeman, Jr. playbook. Those two former sports stars took their paychecks and, as…

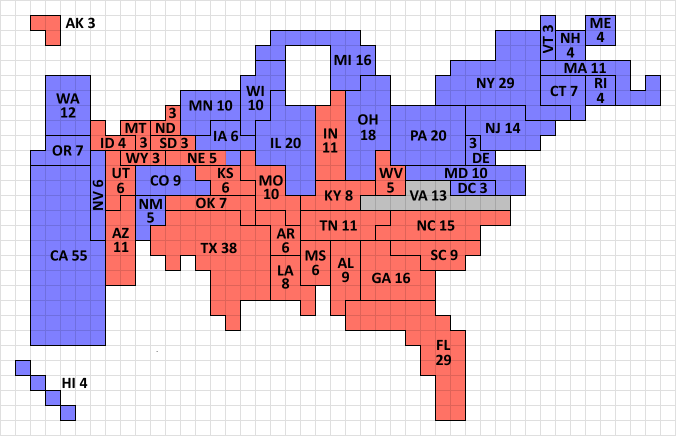

As I go through the results of the 2012 election cycle from a wide range of sources across the political spectrum, including The Wall Street Journal, Fox News, and The Center for American Progress, I am getting … concerned. We need an opposition party in the United States. It creates debate so only the best ideas win, it keeps politicians more honest than they would otherwise be, and it keeps the boat in a narrow center lane so we don’t veer off into extreme in either direction. The Republican party has been taken over by radicals, resulting in a catastrophic demographic and values problem that is now causing it to fail at that vital mission.

With less than 10 hours to go before the polls open for the 2012 Presidential election, I thought it would be a good time to remind you about the importance of using cartograms to study business, political, and socioeconomic data. Cartograms should be a constant tool in your intellectual toolbox that you utilize to overcome…

The most recent statistics on household income, net worth, and unemployment, sorted by education level, are really interesting. Following our discussion about the splits that have emerged along geographic fault lines in the electoral body, I thought it would be important to highlight the economic differences and how enormous the income inequality is for the…

As you probably know by now, The Walt Disney Company has acquired Lucasfilm Ltd. in a $4.5 billion deal. The studio owns franchises such as Star Wars and Indiana Jones. Half will be paid in cash and the other half will be paid in newly minted shares of the company, diluting the existing owners. However, the terms are so favorable that, frankly, it looks like George Lucas took a much lower price than he could have gotten elsewhere solely to have Disney protect the brand, given the latter’s reputation and massive resources. Not even including the cash that Lucasfilm itself produces, Disney could pay for the acquisition in less than 6.7 months using the money generated by its vast empire.

It is remarkable how much more enjoyable your life can be when you refuse to participate in situations that you know are going to end poorly, or work with people in environments that you know are going to cause problems. When you see something like this on the horizon, employ the Grandpa Simpson strategy. In…