Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

With all of the cooking we’ve done in the past few years, one of the biggest changes is the revelation we had about the value of good cheese. There have been three cheeses that stood out as exceptional. We still have a lot to learn about this culinary sub-category, but when you come across a wedge that is a winner, it’s a thrill because you add an entirely new flavor profile to your repertoire.

As I read through the S&P 500 tear sheets this afternoon, I found myself hungry, having not eaten much since last night. I asked Aaron if a short, one-hour trip to the grocery store were a possibility. We ended up making pan-roasted chicken with rosemary, garlic, and white wine.

This ethical dilemma comes from a (presumably) real-world question sent in to Gawker. It caught my attention because we’ve talked about the mental model of information asymmetry, and this is an excellent example of how it plays out in life, as well as the six most common biological sexes found in humans. The Ethical Dilemma: “I’ve been…

I was so excited to hear Ben’s update into the world of plant growing a few days ago, that I had botany on my mind today. Here we are, at the end of the first growing season. Back on April 21st, I wrote about our jump into gardening. We were in the first stages of…

An interesting question from the perspective of a non-U.S. citizen … Joshua, I was pleased to see that around 1/3rd of the site readers are not from the United States. You have truly a global audience. As an American, what do you think is the biggest misconception non-U.S. people have about your country? Ndebele I…

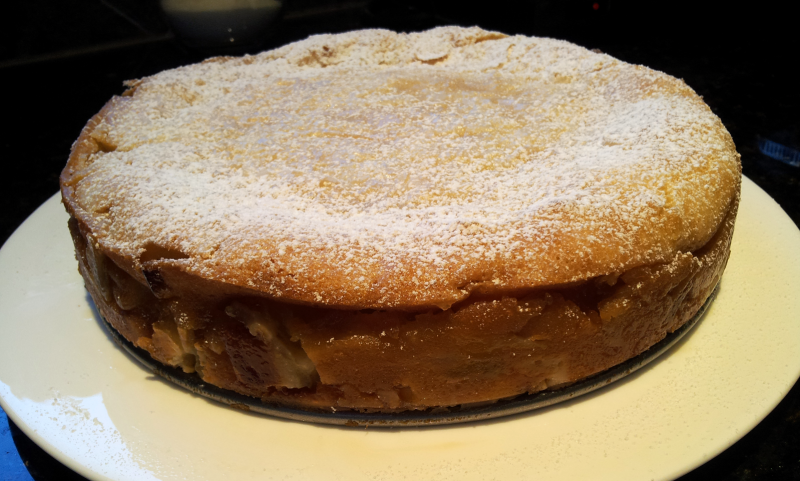

We are heading to my in-laws for dinner tonight, partially to celebrate several people’s birthdays, mine included, and partially just because it’s been a couple of months since we’ve all gotten together. Our contribution is a homemade French apple cake … I won’t be around for the rest of the evening because of it, and…

Here’s an ethical dilemma involving the right to privacy versus the harm principle of morality. The Ethical Dilemma: You are a doctor or a nurse at a regional hospital in your area. One day, as you turn a corner, you see a man you know, the husband of a female friend of yours, walking out of…

For dinner this evening, I wanted to make a tomato and cream sauce to go over stuffed ravioli as it would allow me to use the remainder of the parsley and ricotta filling I needed for the dish I made yesterday. While I considered reaching for our normal tomato and cream sauce, I decided to be productive by at least testing one more recipe from Marcella Hazan.

Here’s a question that serves as an interesting ethical dilemma … The Ethical Dilemma: You are a judge in a developing country where family law leaves much discretion to the person sitting on the bench. A single mother, 18 years old, gives up her child for adoption. The child is adopted by a married couple in…

I woke up this morning, grabbed a cup of black coffee, went straight to work, and dove into some of the things I needed to finish. In the early afternoon, I realized that I was expecting a shipment of books at the house and that I hadn’t eaten so much as a saltine cracker since…