Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

Aaron and I got to be the lucky recipients of an original recipe creation by Jocelyn tonight. The amazing thing was, each serving had only 500 calories after measuring the ingredients and portion sizes.

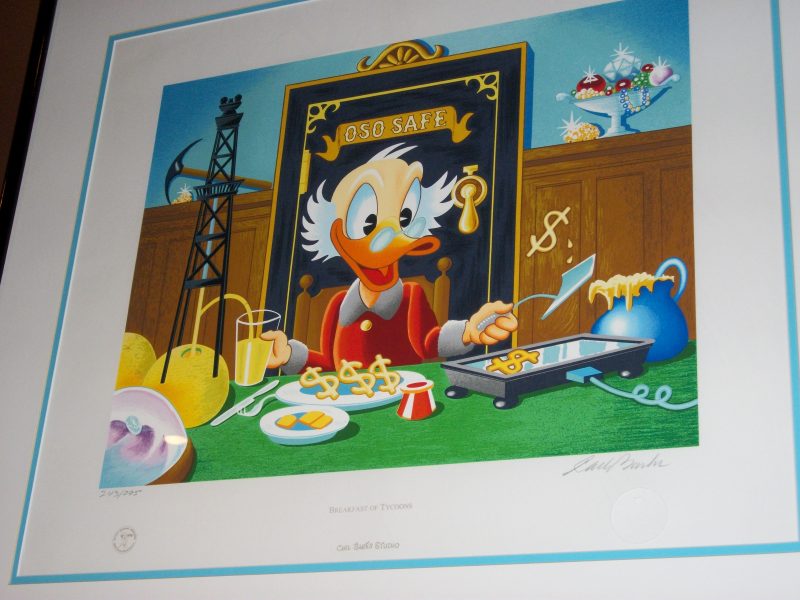

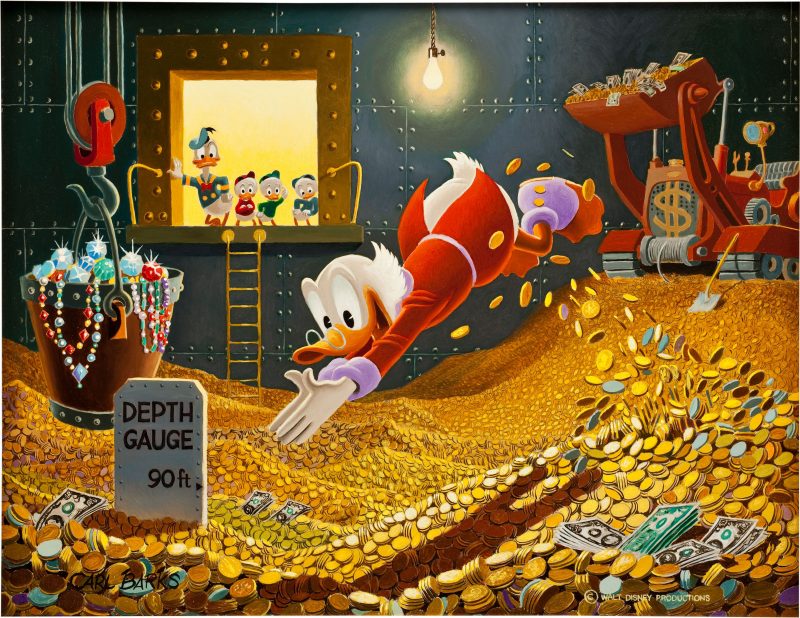

We added Breakfast of Tycoons to the official Carl Barks collection. We’ve been selectively acquiring more and more of his stuff when the price is attractive and it just fits with all of the framed stock certificates and financial artwork.

Mental Model: The Drunkard’s Search The Drunkard’s Search: The tendency for people to search in the easiest places, rather than the ones that are the most likely to yield results. The name comes from the idea of a drunkard seeking his car keys under a street lamp because the light is better instead of where…

I mentioned yesterday in the article on Dairy Queen franchise owners that after graduating from college, Aaron and I had looked into putting capital to work by opening several franchises in the town where we grew up.

Satisficing is a psychological and economic phenomenon that results from consumers choosing a product that meets criteria at an adequate level, rather than expending a great deal more time to find a fully optimal solution.

A few weeks ago, I was reading a political message board where some commentators espoused their sincere belief that all of humanity’s problems will be solved when they succeed in implementing dominion theology. Intrigued, I began to research the concept. What I found was frightening.

From the time I was a kid and had only a few thousand dollars in the bank, I have wanted a Bosendorfer Strauss model grand piano, probably in a 7 foot size (which is comparable to a Steinway & Sons Model B semi-concert grand). Yet, the list price is $111,080 plus you’d be looking at sales tax of roughly $8,331 for a grand total of $119,411. The time value of money opportunity cost of buying a Bosendorfer Strauss grand piano, then is enormous.

A week or two ago, I wrote an article called Understanding Stock Repurchase Plans for About.com, a division of The New York Times, which discussed Sonic Restaurant and the massive stock buy back program that had taken place over the past few years. In it, I walked the readers through a lot of the math and explained that I had purchased a couple hundred shares to watch and monitor the stock through one of my companies, Mount Olympus Awards, LLC. (I’ve since increased it to about 500 shares to continue watching and waiting to see how events unfold).

Early in life, I developed a theory that there were five levels of building wealth that most self-made men (and women) go through to reach financial independence. The theory began due to my love for Carl Barks Scrooge McDuck comics.

I believe one of the signs of a life well lived is the fact that you wake up every morning and jump out of bed because you can’t wait to spend your time focusing on something that makes every part of you – physically, mentally, emotionally, and spiritually – satisfied. This is going to be different for everyone.