Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

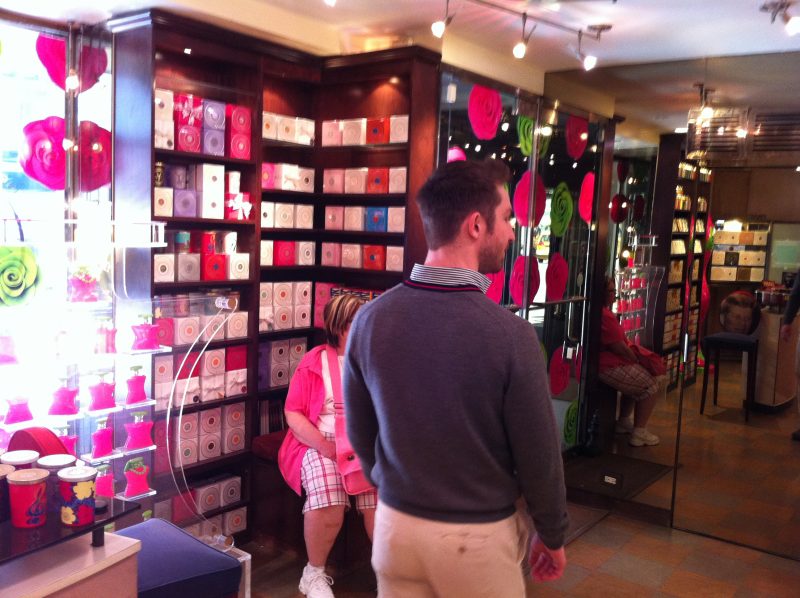

We serendipitously passed the Bond No. 9 perfume house boutique store on Madison Avenue on our way up to the Ralph Lauren mansion to look at wallcoverings for my mom’s home renovation project. Bond No. 9 is one of the other fragrances houses we like to collect besides Creed, although our wardrobes just now began…

We headed to Carmine’s Italian restaurant in New York City’s theater district after seeing Mary Poppins on Broadway. Both Aaron and I have eaten there a few times but my mom wanted to try it after several of her friends back in Kansas City recommended it. We ordered dessert to go, grabbed a cab back…

A Broadway show and dinner was how we elected to spend our evening; more specifically, seeing Mary Poppins on Broadway and then heading up to Carmine’s Italian restaurant, near Times Square. [mainbodyad]All three of us loved the show. It would be perfect if you had kids and wanted to introduce them to the world of…

We just left St. Patrick’s Cathedral and are going to work our way down to Broadway to see Mary Poppins tonight, after which we have reservations at Carmine’s, an Italian restaurant that serves family-style dishes. We ended up waiting in a McDonald’s next to the theatre for about 30 to 45 minutes until the house…

We finally made it into St. Patrick’s Cathedral across the street from the hotel. It was amazing.

We made it to the Natural History Museum in New York City and attended several of the high profile limited time exhibits following our breakfast at Cafe Lalo. In all the years I lived around the area, I never made it to this museum (the Metropolitan Museum of Art and Lincoln Center got a disproportionate…

You know that Tom Hanks and Meg Ryan movie You’ve Got Mail? It is one of my mom’s favorites. (Aaron and I love it, too.) In the movie, Ryan’s character, Kathleen Kelly, is supposed to meet her soul mate, with whom she has only conversed online, at a little place called Cafe Lalo on the…

Time to grab some club soda and other beverages from a local grocer (the in-room dining bar charges $8 per can, I believe. That will drive me nuts.) Then, of course, we came across another cupcake place and so my mom wanted to see it. We left with our basic supplies and on the way…

We have arrived in New York, settled into the hotel, and are trying to get some store browsing in before business closes today since it is late on a Sunday afternoon. We checked into The Palace Hotel. I know we said we were going to be staying at the Waldorf Towers but my mom got…

The house sitters have moved into my townhouse for the next month, the security system has been upgraded, and we are off to New York. It is 9:54 a.m., Central Standard Time, and I am flying somewhere over the Midwest on an Express Jet bound for Newark, where a driver will pick me up and…