Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

My family is having a houseguest fly in from Houston this weekend, but since the house is still under renovation, we had to improvise. An extra bed was put in the formerly empty guest room, which had been vacated as part of the redesign, and we spent all day yesterday running around Overland Park looking…

The news wires are afire this morning because Alistair Barr of Reatuers is reporting that Morgan Stanley, JP Morgan, and Goldman Sachs, the lead underwriters on the Facebook IPO, all cut earnings forecasts for social network giant during the IPO roadshow. Even worse, the banks then allegedly passed this information on to only a handful…

Imagine you have a friend. You do everything for him. You don’t feel like he’s particularly responsible, but you still help him pay off his credit card debt, drive him to work, help him study, and take him to the free clinic when he shows up on your doorstep after a night of binge drinking.…

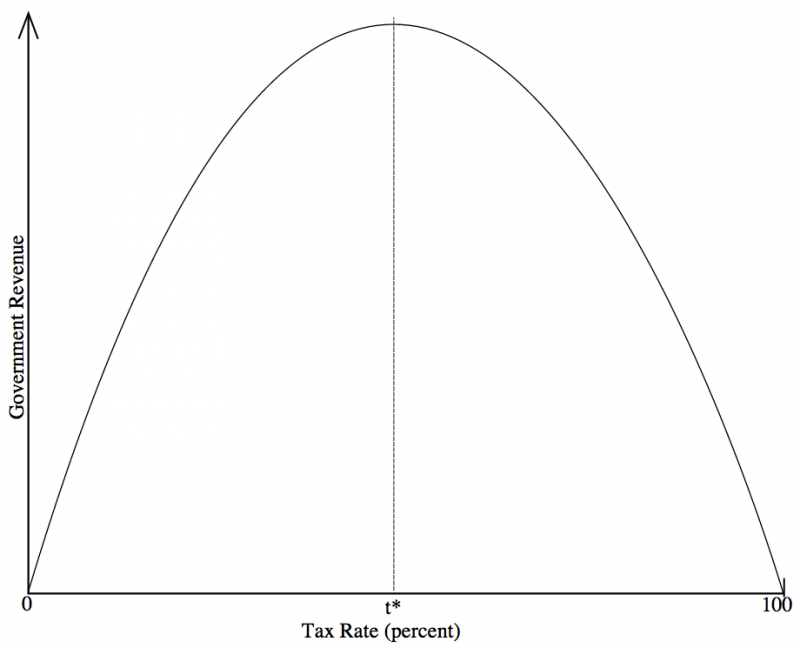

The velocity of money is one of the most important economic concepts you can ever learn. It isn’t perfect, and it doesn’t fully capture vital influences on the way a nation’s money supply behaves as driven by behavioral economic considerations such as mass panic, fear, overoptimism, et cetra, but it does have very important implications…

In a couple of weeks, we will see the three year anniversary of the end of the Great Recession, which was the worst economic crisis to hit the United States since the 1930’s and ran from December of 2007 through June of 2009. (For those of you who aren’t familiar with the definition of the…

When people talk about “borrowing money”, it isn’t entirely accurate. What is really happening is renting someone else’s property. It doesn’t matter if you are talking about credit card debt or student loan debt. Imagine I own a $100,000 lake cabin. You want to take your family on a vacation this summer, so you approach me and…

The United States is facing a significant cultural challenge driven by basic biology that could radically redefine our socioeconomic structure. That isn’t hyperbole, it’s a statement of fact. Several years ago, I began reading research papers, essays, and other data on assortative mating patterns in human populations. In essence, people want to be around people…

One old definition of “being rich” is when your money earns money. This afternoon, I was writing a piece and reviewing the dividend yields on some of the common stock holdings owned by my household personally, outside of the business, when I began quantifying that in the back of my mind. How much would it…

Just Because Something Is Old Does Not Mean It Is Right A significant error in thinking comes from people using “It has always been this way” as justification for the state of things. As if, somehow, precedence confers legitimacy. Just because something is old does not mean it is right. Being long-established does not mean…

My schedule was completely reshuffled this afternoon because my grandmother and four-year-old niece stopped by for a wonderful surprise visit. During the conversation, it came up that Ellie had never seen Mary Poppins. Completely unacceptable! We cancelled everything else for the day, bought it on Apple TV, made English tea with sugar and milk (though,…