Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

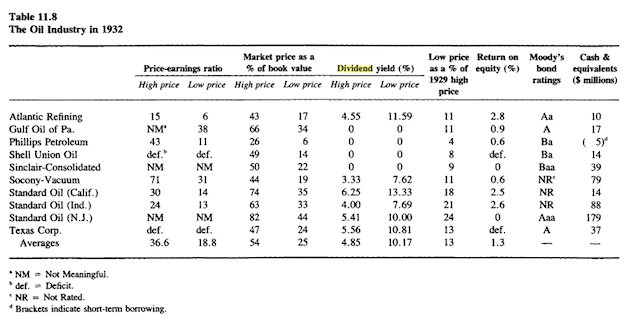

I’m working my way through a 1985 book called The Crash and Its Aftermath: A History of Security Markets in the United States, 1929-1933, which covers the darkest days America has ever known. In 1932, during the depths of the Great Depression, the long-term United States Treasury bond yield was 4.25%. At this moment in time,…

We opted for an anti-social Superbowl Sunday, stayed home, worked on some projects that needed to be finished, and after they were done, ended up testing several dessert recipes including one from the old Betty Crocker cookbook and another from America’s Test Kitchen. They both turned out extraordinarily well. The peanut butter sandwich cookies are…

A comment reply I needed to post about the Wachovia banking collapse was too large to fit in the comment thread so I am publishing it as a mail bag feature. It deals with my thoughts on investing in bank stocks and holding a large exposure to the banking industry.

As promised several months ago, we implemented demographic tracking on the site to the list of other abilities we have and are now collecting data. Using one popular source, which will improve over time as a bigger sample is developed, the trend that is showing up everywhere is evident. It should only get better as more data points are put into the pool, so I’m excited to see who, exactly, is reading.

Some of you have written to me and asked how I work through the “too hard” pile of things I need to come back to in the future. For me, I keep a system of thought files, on specific topics, and spend several weeks working through them, until I have nothing else to add. They…

With the benefit of hindsight, I now realize that the curriculum committee in my small farm town growing up was made up of visionary geniuses. Either that, or they were a bunch of eccentrics who were paranoid about everything. Maybe both.

This is the second in a three-part post on narcissism; the topic du jour for our mental model study. We’ve been talking about narcissism for the past few days and one interesting thread that comes up throughout history is that narcissism, despite being horribly destructive and disruptive, can work, in rare situations, in the favor…

I’m continuing to make progress with the project I told you about a few weeks ago. This evening, I am tasked with emptying out much of the kitchen and replacing it with the Le Creuset cookware we bought earlier today now that the Ruffoni and Mauviel copper pots are scheduled to have a permanent, organized…

To my fellow Kansas City residents: You may want to head over to the Le Creuset store in Leawood, Kansas. The sales deals are unbelievable and this is a brand that isn’t always easy to find at a discount. Some pieces are marked down by 45%, if you buy more than $150 you get a…

A homemade beef stock is the foundation of so many recipes. Yet, making homemade beef stock can take a big time investment, not to mention needing bones, meat, and other ingredients on hand. One of the best tips I’ve seen came from the legendary cookbook author Julia Child, who found a way to treat canned…