Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

Imagine you have a policy with an insurance company. This insurance company is mutually run, which means there are no stockholders. Instead, the policyholders own the business and the enterprise is managed to give policyholders the best service, at the lowest possible price, as a cooperative undertaking. Now, imagine that one day, the policyholders’ representatives decide they want the business to become a for-profit corporation.

We decided to make a delicious Korean Dwaejigogi-bokkeum recipe from Maangchi. We were not prepared for the level of burn.

I’ve tried to keep some semblance of privacy around my life since the blog audience has grown but, for a brief moment in time, I’m going to suspend that rule and write to you like I would have circa 2009 when it was mostly just Aunt Donna and a few other readers. Being so exposed makes me…

My earliest memories in life are in the early 1980’s. At that time, the older generation who cooked the food at family gatherings, church dinners, and social events in small town America that made up the fabric of my childhood was born between the late 1800’s and the mid 1920’s. There was a certain common thread that…

In a matter of a few hours, we’ve gone from putting our house on the market and leaving our home state back to square one. When I woke up, this is not how I anticipated spending my day. This morning, the Supreme Court effectively struck down the marriage bans in 11 states, five of which were involved in…

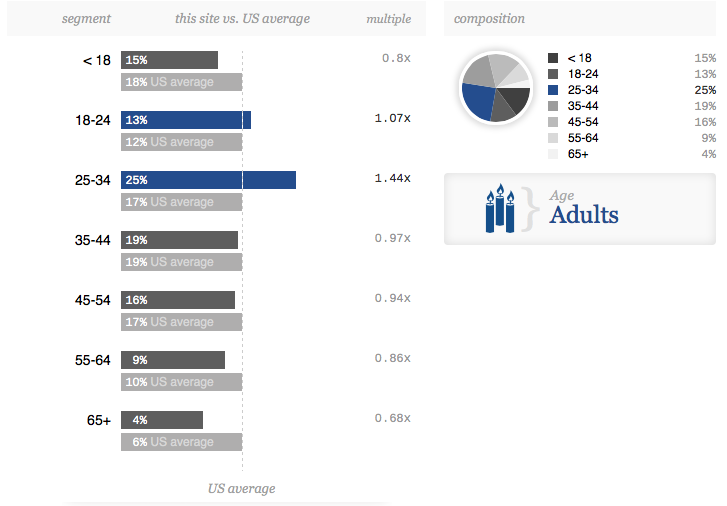

Like the residents of Lake Wobegon, another year of better data analytics and audience growth has cemented what we’ve already known: As a group, you’re way above average. You are considerably richer and better educated the average person in the United States, more likely to identify as politically independent, more likely to have children, and skew…

As I’ve grown older, I find myself fascinated by the power of social capital; specifically, how it encircles the person who possesses it with a halo that sets them apart from society even when they are far from the only snowflake. People often mistake fame with competency or ability. This tendency is part of human nature so it…

Mental Model: Intergenerational Transmission and What It Has to Do With Adrian Peterson Beating His Child A huge percentage of the people in this community are fans of the mental model concept – ideas, like tools, that can be used to analyze, study, and understand both why and how something is happening – made popular by Charles…

This is a great question about habits of successful people and families … I read your post about energy savings and saw a comment from from someone named Melissa K. You had responded to a reader from overseas and shifted your language and units to their syntax, talking in square meters and degrees Celsius rather square…

It’s no secret that most wealth in the United States is so-called stealth wealth. We now live in a country where roughly 1 in 5 families earns six-figures a year or more, which most people wouldn’t believe, and for those who put aside money, something like 80%+ of millionaires hide their net worth from friends and…