Joshua Kennon is a Managing Director of

Kennon-Green & Co., a private asset management firm specializing in global value investing for affluent and high net worth individuals, families, and institutions. Nothing in this article or on this site, which is Mr. Kennon's personal blog, is intended to be, nor should it be construed as, investment advice, a recommendation, or an offer to buy or sell a security or securities. Investing can result in losses, sometimes significant losses. Prior to taking any action involving your finances or portfolio, you should consult with your own qualified professional advisor(s), such as an investment advisor, tax specialist, and/or attorney, who can help you consider your unique needs, circumstances, risk tolerance, and other relevant factors.

I was reading a site called Student Loan Justice as well as a piece at the Huffington Post where people are talking about their “overwhelming” student loan debt that is – wait for it – $15,000 or $30,000. Basically, less than the value of a car. Or tobacco costs for a couple, both of whom smoke a pack of cigarettes each day for five to ten years. Or 4 to 8 months of pre-tax income for the average American household.

Everyone focuses on the stuff the rich people collect. Yet, the biggest secret is that the rich are really collectors of rents, royalties, dividends, and interest. Whether song rights, hotel ownership, businesses, sales commissions, stocks, timberland, or patents, these are the things they truly amass.

Here’s how you can find investment ideas using an example from my own family’s experience running a successful sporting goods store.

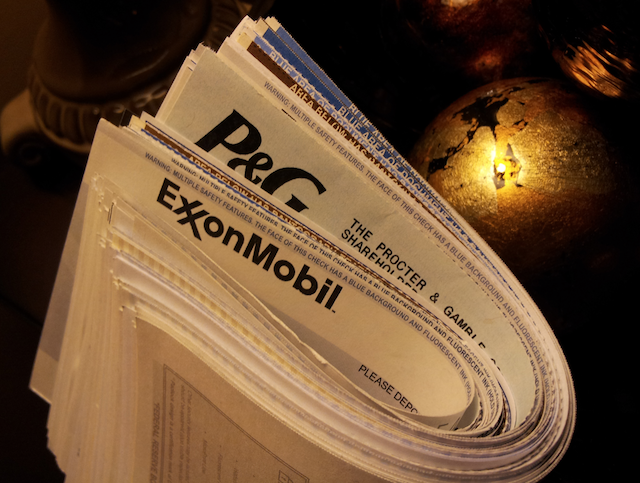

A member of my family has been using a technique to build substantial wealth that doesn’t require a high income or any specialized knowledge, extra work, or effort. I was so impressed by the way he implemented this program, I thought I would share it with my other family and friends (as well as anyone else who reads my blog) without giving away who it is.

I was up until 6:30 this morning reading Stop Acting Rich … By Thomas J. Stanley, Ph.D., the author of the incredibly successful The Millionaire Next Door and The Millionaire Mind. It’s remarkable because so much of what the “average” millionaire did to achieve his or her wealth is exactly, precisely the same things I, and members of my own family, did to become financially independent.

John Templeton was a billionaire mutual fund pioneer that specialized in using a value investing strategy to buy stocks around the world. By practicing a disciplined version of Benjamin Graham’s teaching on a global scale, Templeton amassed an astounding record that made shareholders of his fund wealthy and earned him hundreds of millions of dollars in well-deserved fees. Toward the end of his life, John Templeton ran his international investments from his mansion on Lyford Clay in the Bahamas.

One of the least discussed secrets of great practitioners of the value investing strategy is the use of cash, cash equivalents, and bonds to augment returns. From Benjamin Graham and Warren Buffett to Wallace Weitz and Marty Whitman, intelligent use of excess funds has as much to do with growing your capital over the long run as does selecting individual common stocks. We’re going to look at some of the techniques that have been used by value investors to manage their reserves, and the role played in the overall portfolio.

The focus value investing strategy is different from traditional, Benjamin Graham value investing strategy because it is based upon the idea of putting money into more of an investor’s “best ideas”, as Warren Buffett put it. Some value investors despise focused investing, while others swear by it. I’m always very hesitant to talk about this particular strategy on Investing for Beginners where I publish my investing articles for total newbies, mostly because some lazy person may not study far enough and realize that focused value investing is only possible when someone has diversified income sources. Done wrong, it can be financially devastating.

Peak earnings are a common value investing trap that most often hurts inexperienced investors who look only at the earnings per share and not the underlying driver of those profits. The last big round of peak earnings value traps occurred at the end of the housing bubble. By knowing what to look for, you’ll be better equipped to spot value traps, lowering the chances your portfolio will be damaged by them.

Many famous portfolio managers that practice a value investing strategy have said they think of stocks as “equity bonds”. Instead of receiving a fixed rate of return, like you would when you buy a traditional bond, you receive a variable return based on the company’s underlying profit. This approach makes it easier to value a business. The most common starting point for the valuation process is calculating a financial ratio known as earnings yield. In this article, you will learn what the earnings yield ratio is, how to calculate it, and why it is important to so many value investors.